- Due Date for Income tax Compliance (February2022)

| 7th February2022 |

Deposit of TDS/TCS deducted /collected for the month of January, 2022 |

| 14th February2022 |

Issue of TDS Certificate for tax deducted under section 194-IA/194-IB and 194M in the month of January, 2022. |

| 15th February2022 |

Furnishing of Form 24G by an office of the Government where TDS/TCS for the month of January, 2022 has been paid without the production of a challan. |

| 15th February2022 |

Quarterly TDS certificate (in respect of tax deducted for payments other than salary) for the quarter ending December 31, 2021. |

| 15th February2022 |

Due date for filing of audit report under section 44AB for the assessment year 2021-22 in the case of a corporate-assessee or non-corporate assesses (who was required to submit his/its return of income on October 31, 2021)

Due date for filing report under section 92E relating to international transaction and specified domestic transaction |

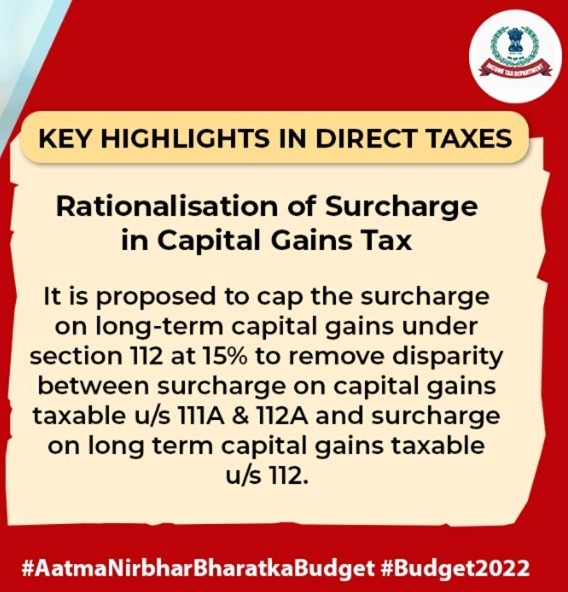

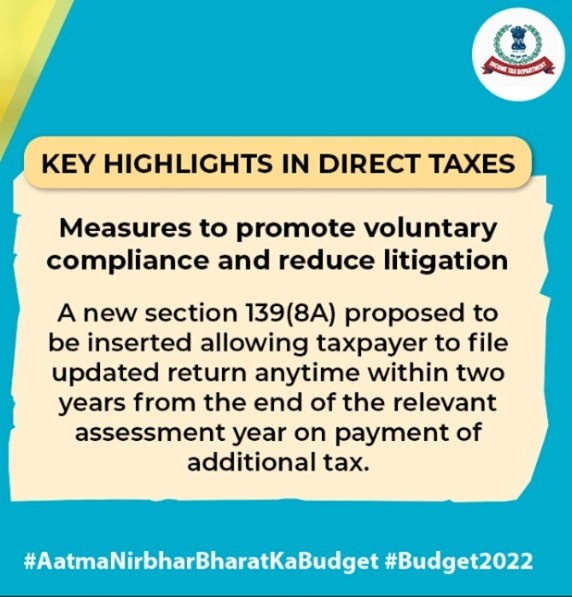

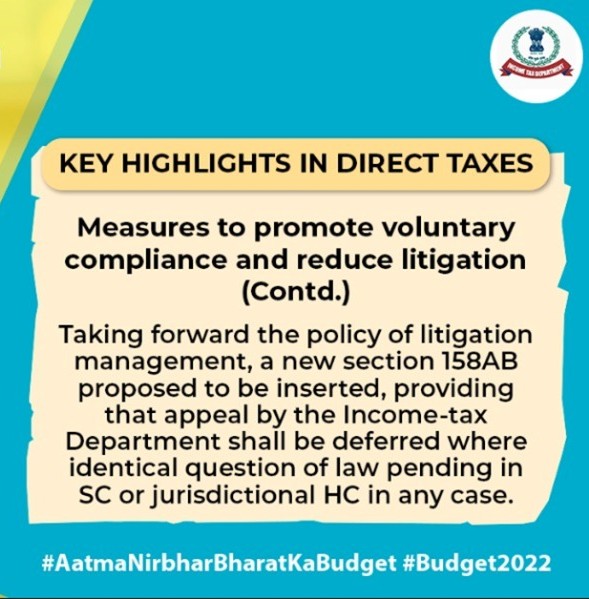

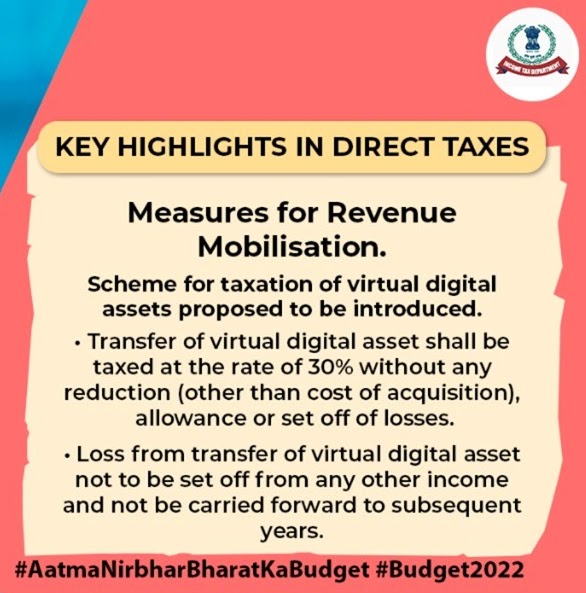

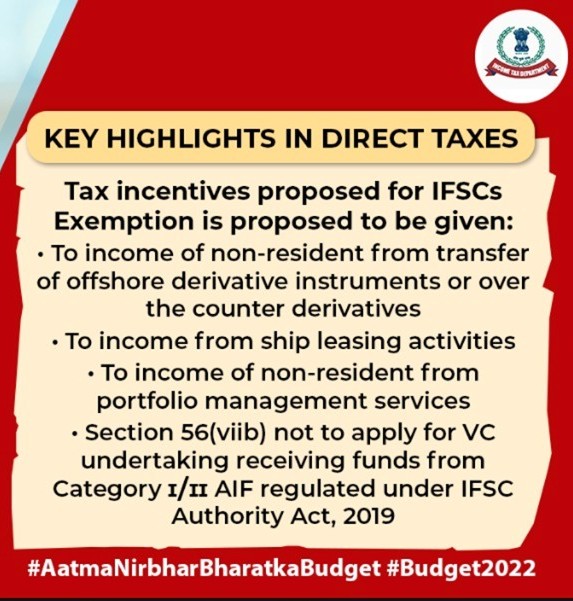

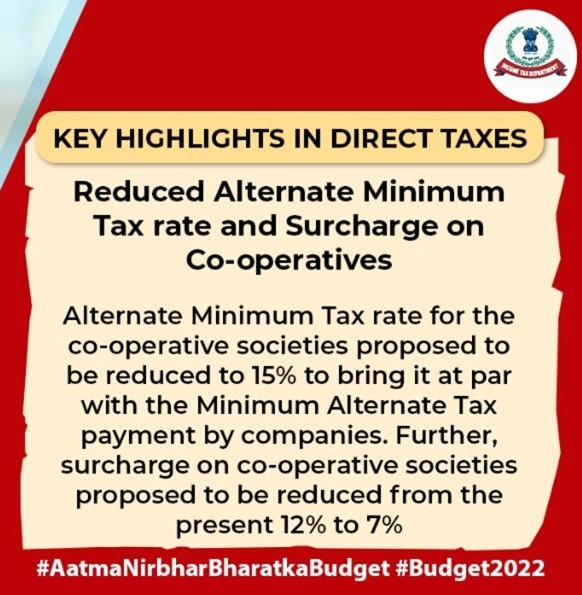

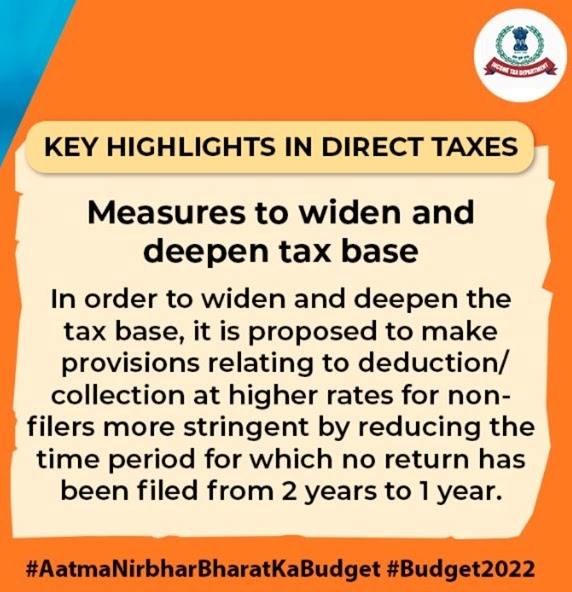

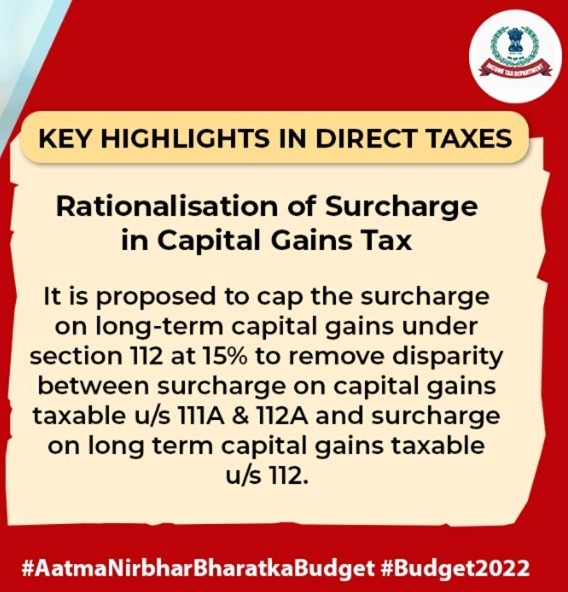

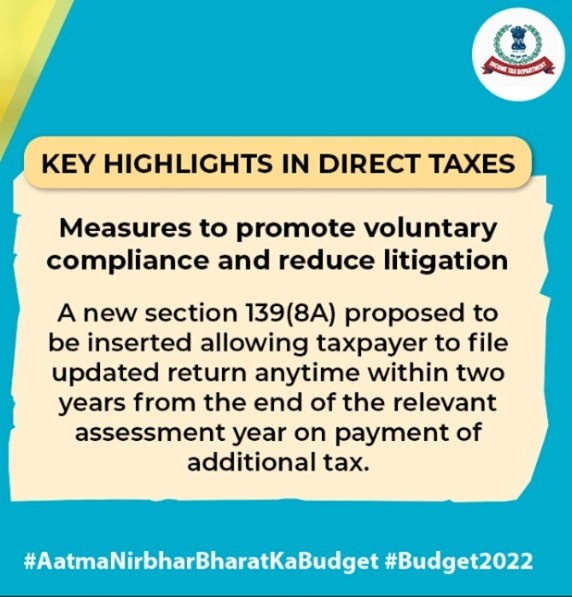

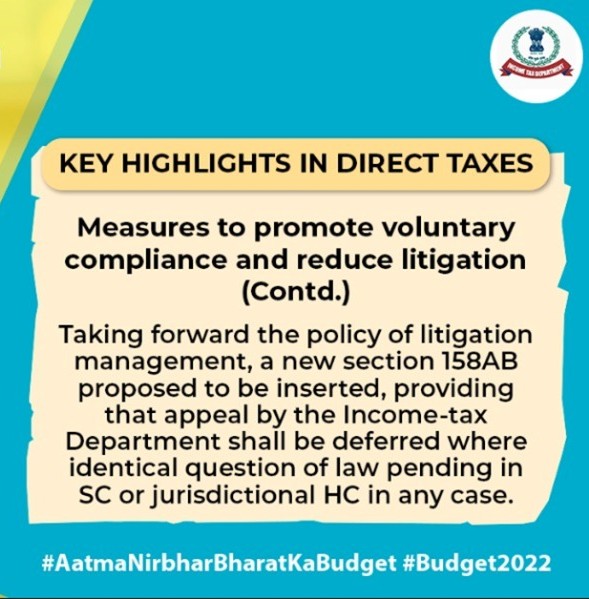

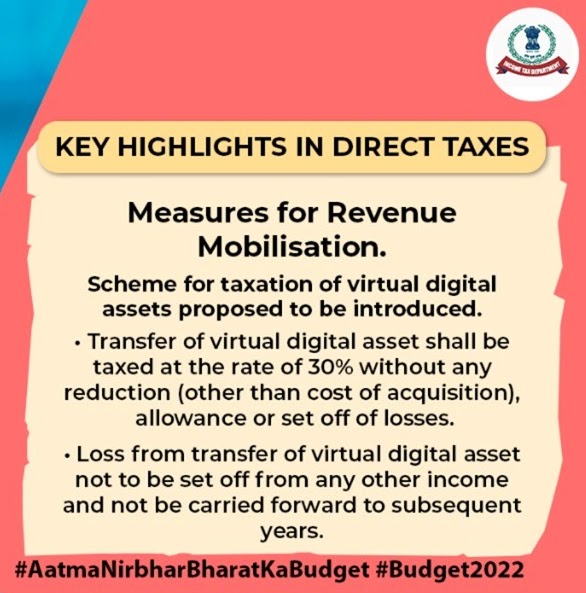

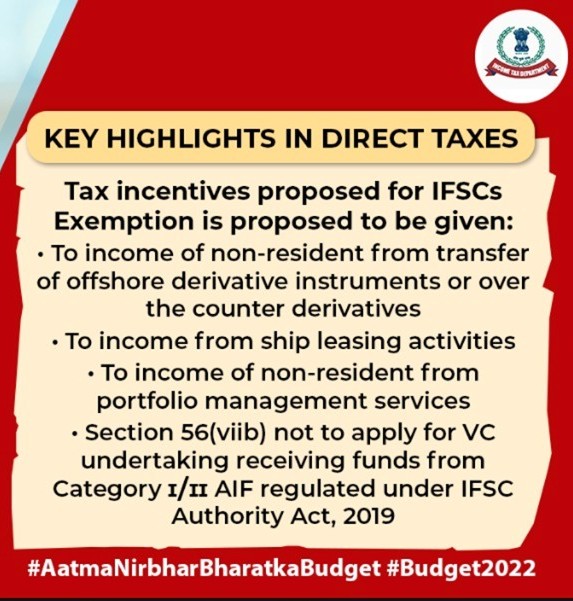

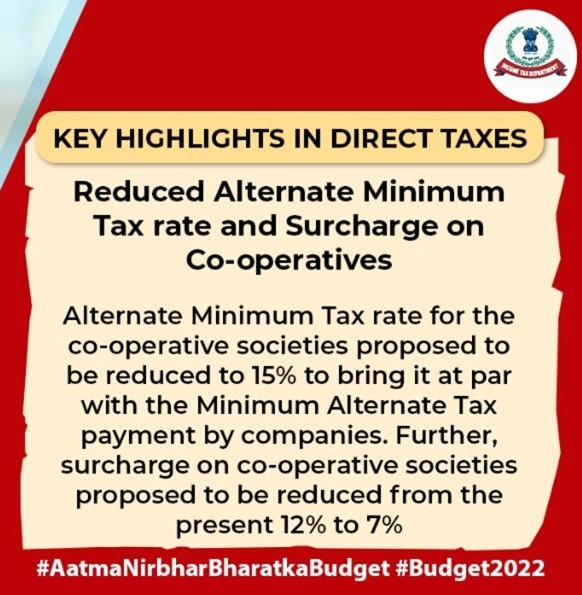

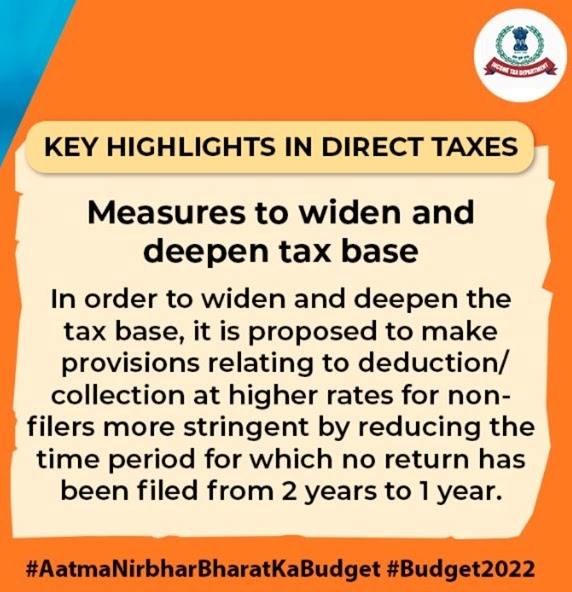

Propose Budget 2022 (Direct Tax Provisions)

Income Tax Notifications and Circulars –November2021, December2021, January 2022

- Guidelines for TDS on e-commerce transaction and purchase of goods, TCS on goods.

To remove the difficulties, certain additional guidelines are provided vide circular no.20 of 2021 dated 25.11.2021 and highlights of the same are as under.

– TDS is not required to be deducted u/s 194O on e-commerce transaction in relation to e-auction activities carried out by e-auctioneers (if all the specified conditions satisfied). However, buyer and seller would still be liable to deduct/collect tax as purchase/sale of goods, as applicable.

– Like GST, TDS on purchase of goods will be applicable on the amount credited without including VAT/Excise duty/Sales tax/CST (only if TDS is applicable on credit basis and not payment basis)

– TDS u/s 194Q will be applicable even on goods which are utilized for the purposes of manufacturing, processing or producing articles or things or for the purposes of generation of power and not for trading purposes

– Department of the Government which is not carrying out any business or commercial activity, will be exempted from requirement of TDS of purchase of goods (as buyer or seller) u/s 194Q. However, Public sector Undertaking or corporation established under Central or State Act or any other such body, authority or entity, shall be required to comply with the provisions.

– For the purposes of section 194Q, Central Government or State Government shall not be considered as ‘seller’ and no tax is to be deducted by the buyer, in cases where any Department of Central or State Government are seller of goods.

2 Prescribed authority will issue notice for unverified AIS data

As per Section 133, 133B, 133C, 134, 135; various income tax authorities have power to collect information from firm, HUF, trustee, guardian, agent, dealer, broker, banks etc.

The CBDT has notified the e-Verification Scheme, 2021, effective from 13-12-2021 (Notification No. 137 /2021) wherein Principal Director General of Income-tax (Systems) or Director General of Income-tax (Systems) will process or utilise the information.as follows:

- The Principal Director General of Income-tax (Systems) or Director General of Income-tax (Systems), shall make available the information to the Commissioner of Income-tax (e-Verification)

- Commissioner of Income-tax (e-Verification) will get data which is not accepted by assessee or in no response has been received from the assessee within 90 days OR where no registered e – mail account or mobile number is on record.

- Initial e-verification by the Commissioner of Income-tax (e-verification) shall be done from the source (from where the information is received)

- In case of mismatch data, a risk management strategy shall be applied, for further action

- Final verification report shall be made available electronically to the Faceless Assessing Officer or Jurisdictional Assessing Officer, as the case may be (if scrutiny is pending)

- For the purpose of verification of information, the Prescribed Authority shall issue notice to a person requiring him to furnish information or documents as necessary for such verification. No person shall be required to appear personally, however, person can request for VC hearing

- Registered e-mail for the scheme shall be the e-mail address available in the electronic filing account of the addressee registered in the designated portal; or available in the last income-tax return or available in PAN or available in Aadhar or in the case of addressee being a company, available with MCA; or available by other prescribed authority

- Registered mobile number for the scheme shall be mobile number of the assessee, or his authorised representative, appearing in the user profile of the electronic filing account registered by the assessee in designated portal or available with Aadhaar

- Risk management strategy for the scheme shall be an algorithm for standardised examination of information, by using suitable technological tools, including artificial intelligence and machine learning, with a view to reduce the scope of risk, as decided by the Board from time to time.

3 Preparation for new reassessment notice begins (as per amended provisions of Sec 148)

Vide instructions dated 10.12.2021 (F.NO.225/135/2021/ITA-II), CBDT issued direction to AO to identify information to make implementation of risk management strategy effective. Accordingly, following data pertaining to Assessment Year 2015-16 and Assessment Year 2018-19, was required to upload by 20th Dec 2021 in Insight Portal.

(a) Information from any other Govt. agency/law enforcement agency

(b) Information arising out of internal Audit objections

(c) Information received from any Income-tax Authority including the AO himself

(d) Information arising out of search or survey action

(e) Information arising out of FT&TR references

(f) Information arising out of any order of court has an impact on income of assessee or any other assessee

(g) Case involving additions on a recurring issue of law or fact:

- Exceeding Rs. 25 lakhs in eight metro cities while at other charges, quantum of addition should exceed Rs. 10 lakhs;

- Exceeding Rs. 10 crores in transfer pricing cases.

However the addition referred in point (g) shall be such addition which:

– Has become final as no further appeal has been filed against the assessment order; or

– Has been confirmed at any stage of appellate process in favor of revenue and assessee has not filed further appeal; or

– Has been confirmed at the 1st stage of appeal in favor of revenue or subsequently; even if further appeal of assessee is pending against such order.

Where the Assessing Officer has in his possession evidence which reveal that the income escaping assessment, represented in the form of asset, amounts to or is likely to amount to fifty lakh rupees or more, notice can be issued beyond the period of three years but not beyond the period of ten years from the end of the relevant assessment year. Further, the notice cannot be issued at any time in a case for the relevant assessment year beginning on or before 1st day of April, 2021, if such notice could not have been under old provision.

4 Is your last year return (AY 20 21) pending for verification?

As per circular 21/2021, all lTRs for Assessment Year 2020-21 which were uploaded electronically by the taxpayers within the time allowed and which have remained incomplete due to non-submission of ITR-V Form/pending e-Verification; can be verified by 28.02.2022 and return shall be processed by 30.06.2022.

This relaxation shall not apply in those cases, where during the intervening period; Income tax Department has already taken recourse.

5 Revised faceless appeal scheme notified on 28.12.2021 (Notification 139/2021).

Highlights of scheme are as follows:

- Registered e-mail address includes email available at e-filing portal, ITR, PAN, Aadhar, MCA records and authorized person.

- Where CIT(A) intends to enhance an assessment or a penalty or reduce the amount of refund, CIT(A) shall prepare a show-cause notice containing the reasons for such enhancement or reduction.

- CIT(A) can levy penalty for non-compliance of notice/direction/order.

- CIT(A) can pass rectification order for mistake appearing from record on receipt of application

- Personal hearing will be conducted on request through video call. CIT(A) SHALL allow request for personal hearing

6 .148 notice controversy

Calcutta HC held that respectfully agreeing with the reasonings and views taken by the Allahabad High Court, Rajasthan High Court and Delhi High Court, all the impugned notices issued after 31st March 2021, under Section 148 of the Income Tax Act are quashed with liberty to the Assessing Officers concerned to initiate fresh re-assessment proceedings in accordance with the relevant provisions of the Act as amended by Finance Act, 2021 and after making compliance of the formalities as required by the law.

7.Due dates for filing ITR and various reports extended

Vide Circular No. 01/2022 dated 11.01.2022 , date of furnishing audit reports was extended to 15.2.22 and date of filing ITR (Audit cases) was extended to 15.3.22

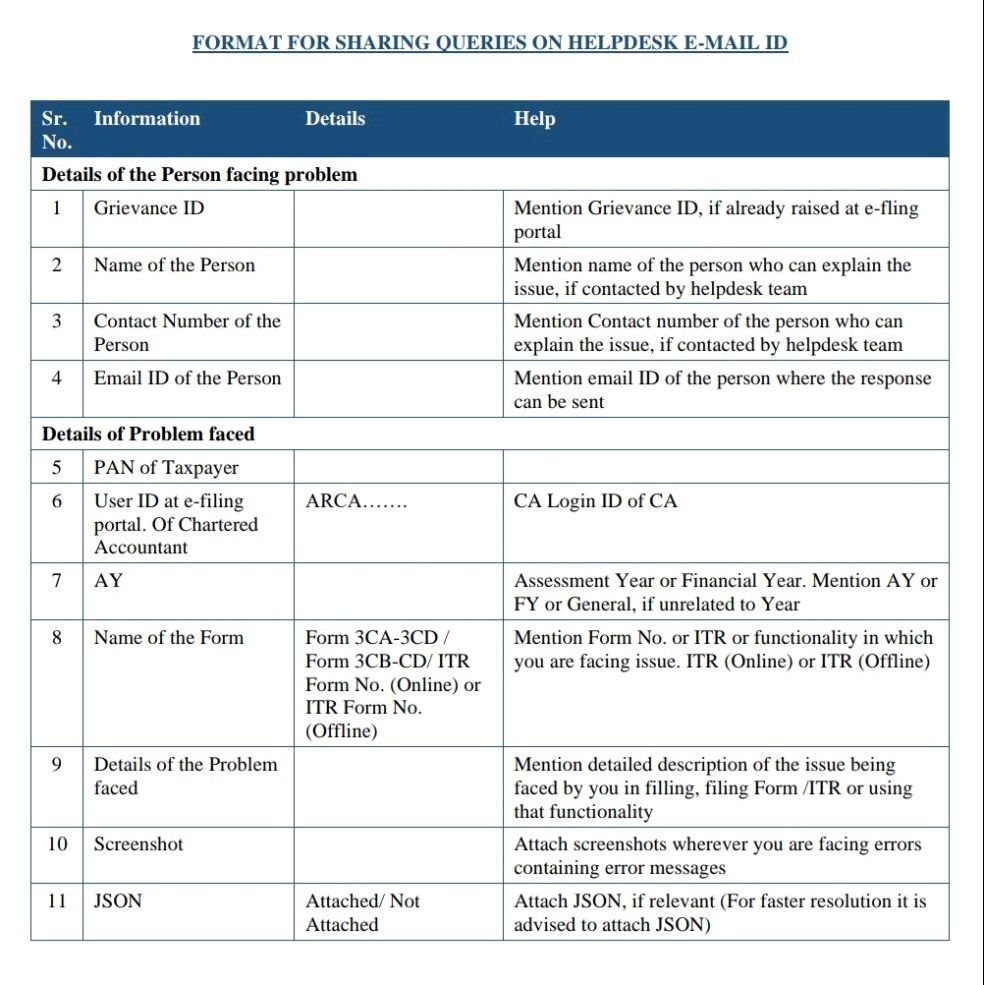

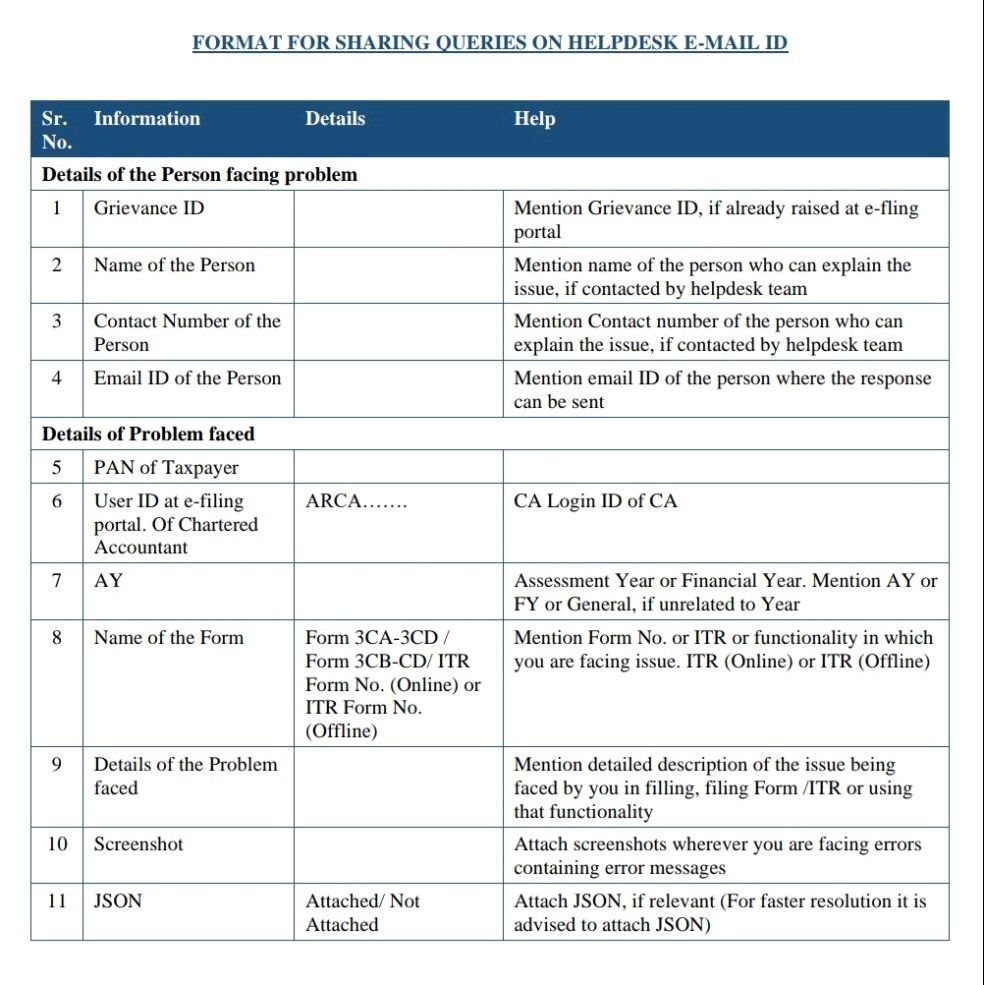

8.Helpdesk email id for issues (tax audit and ITR) at new portal

For queries related to tax audit (for AY 21-22), you can send mail TAR.helpdesk@incometax.gov.in and ITR.helpdesk@incometax.gov.in for queries related to ITRs (ITR 1 to ITR 7 for AY 21-22). Format for sharing queries on helpdesk E-mail IDs (check below image)