Due Date for Income tax Compliance (JULY 2021)

| 7th July 2021 |

Deposit of TDS/TCS deducted /collected for the month of June,2021 |

| 15th July 2021 |

Issue of TDS Certificate for tax deducted under section 194-IA/194-IB and 194M in the month of May, 2021 |

| 15th July 2021 |

TDS return filing for the quarter ending March 31, 2021 for FY 2020-21 (Vide Circular 09/2021, dated 20-05-2021 and Circular 12/2021, dated 25-06-2021) |

| 15th July 2021 |

Quarterly statement of TCS deposited for the quarter ending 30 June, 2021 |

| 30th July 2021 |

Quarterly TCS certificate in respect of tax collected by any person for the quarter ending June 30, 2021 |

| 30th July 2021 |

Furnishing of challan-cum-statement in respect of tax deducted under section 194-IA/194-IB and 194M in the month of May, 2021 |

| 31th July 2021 |

TDS return filing for tax deposited for the quarter ending June 30, 2021 for FY 2021-22 |

| 31th July 2021 |

Certificate of tax deducted at source to employees (Form No.16) in respect of salary paid and tax deducted during Financial Year 2020-21 (Vide Circular 09/2021, dated 20-05-2021 and Circular 12/2021, dated 25-06-2021) |

| 31th July 2021 |

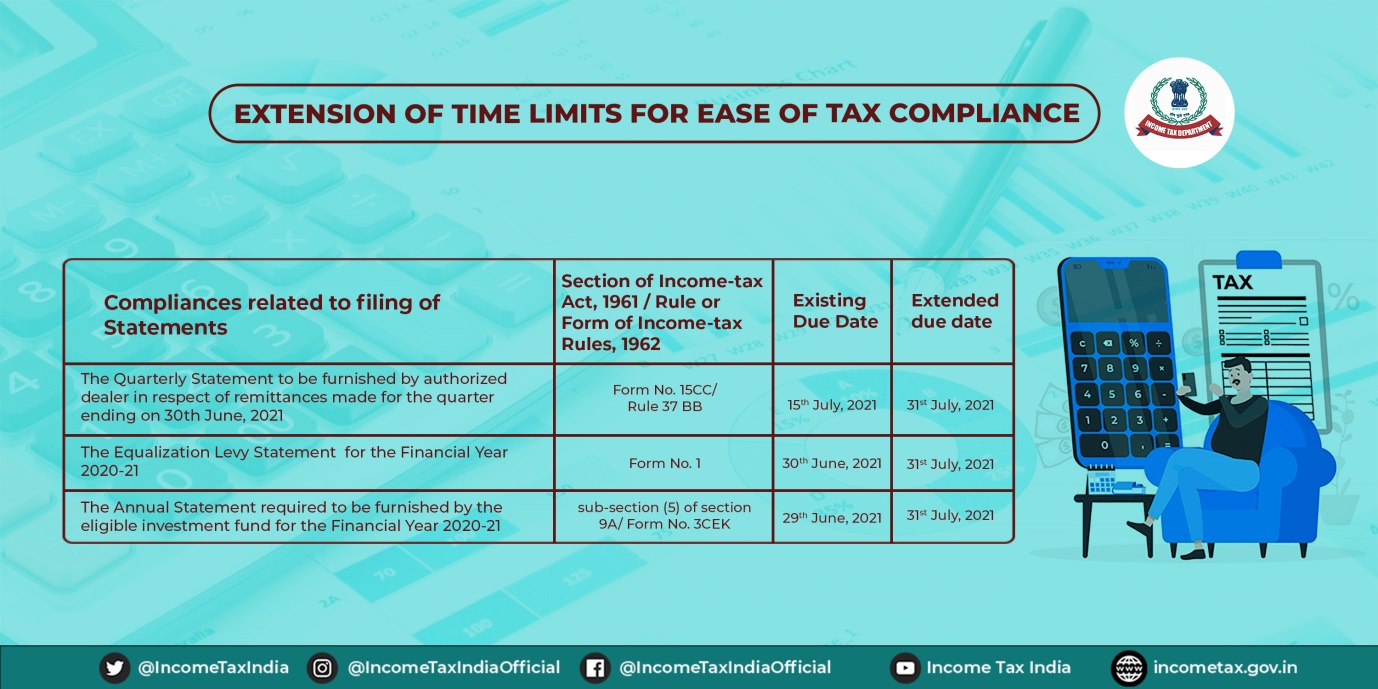

Filling of Statement of Equalization Levy in Form no.1 for Financial year 2020-21(Vide Circular 12/2021, dated 25-06-2021) |

Notifications and Circulars of June 2021

1. Cost inflation index for Financial Year 2021-22 / Assessment Year 2022-23 notified :

The the Central Board of Direct Tax (CBDT) notifies ‘317’ as Cost inflation index for Financial Year 2021-22 / Assessment Year 2022-23. This shall come into force with effect from 1st day of April, 2022 and shall accordingly apply to the Assessment Year 2022-2023 and subsequent years.

(Notification No.73/2021/F.No.370142/10/2021-TPL, dated 15th June 2021)

2. Direct Tax Vivad se Vishwas Act, 2020 :

The Central Government amendments last date of payment of amount under Vivad se Vishwas (without additional amount) which was earlier extended to 30th June, 2021 is further extended to 31st August, 2021 and last date of payment of amount under Vivad se Vishwas (with additional amount) has been notified as 31st October, 2021.

(Notification No. 75/2021/ F.No.IT (A)/01/2020-TPL, Dated 25th June 2021)

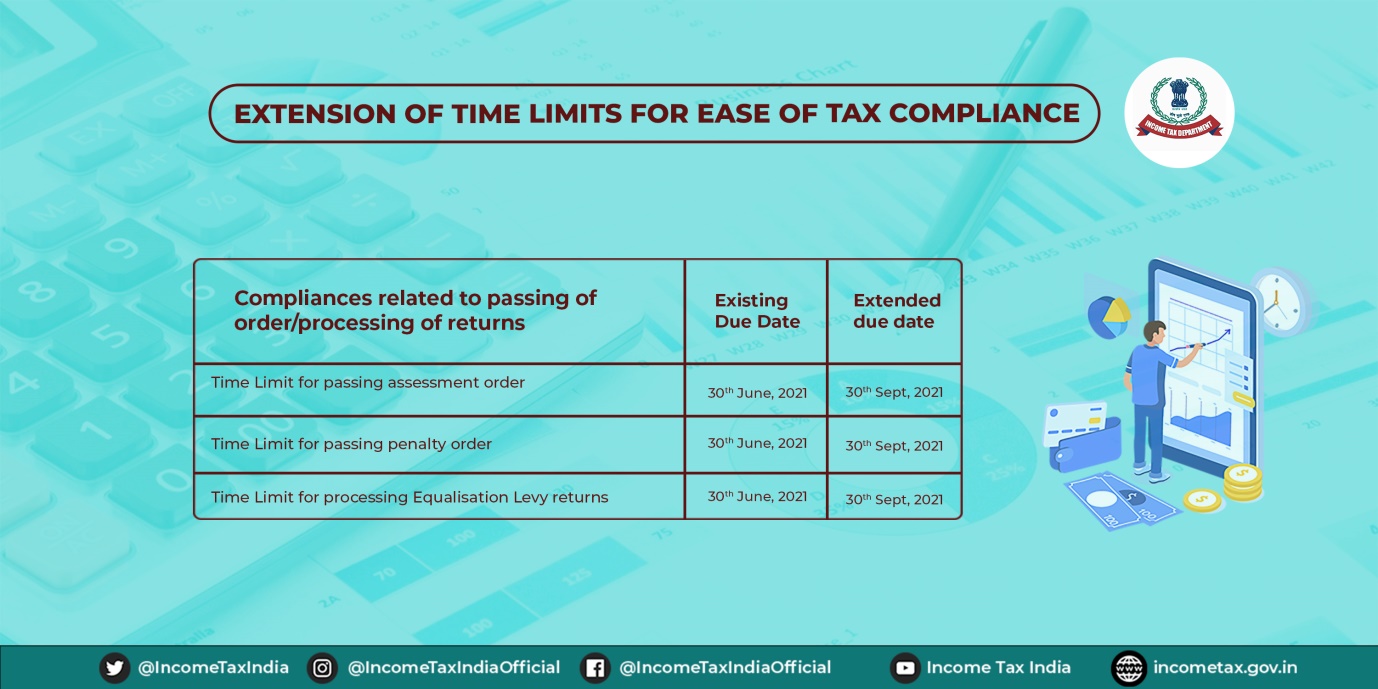

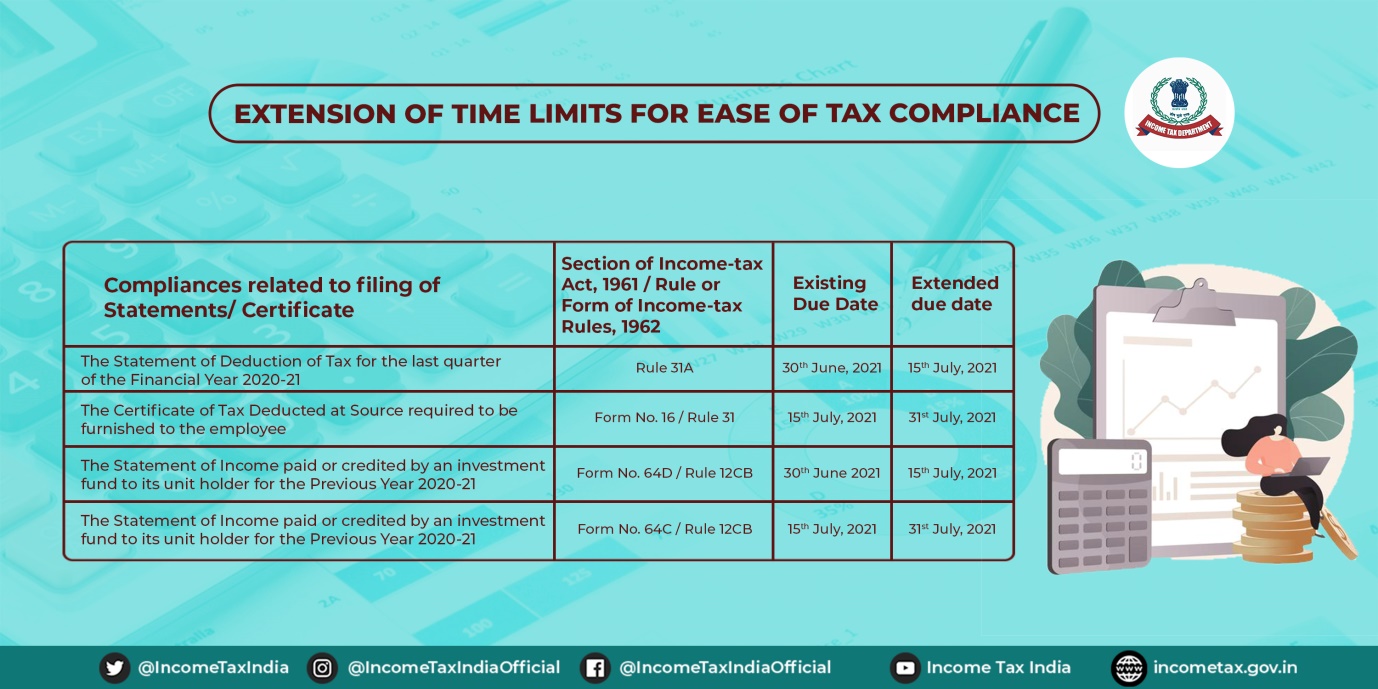

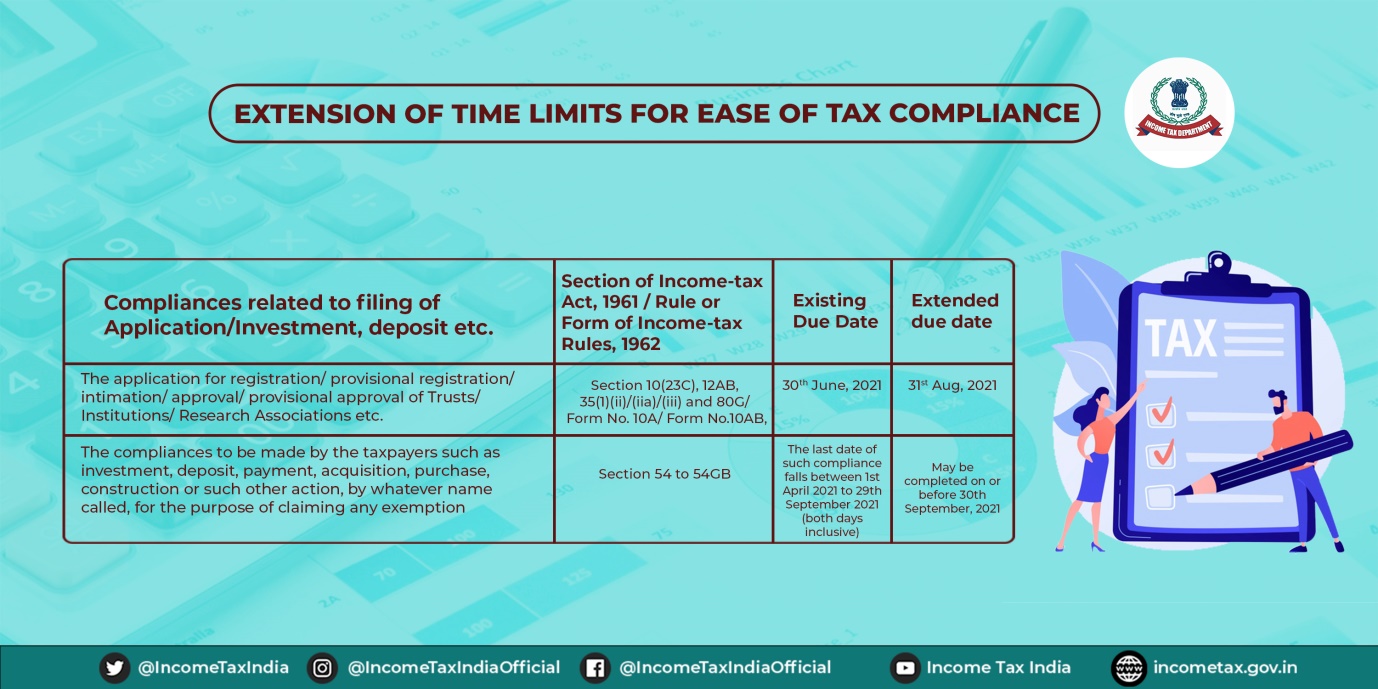

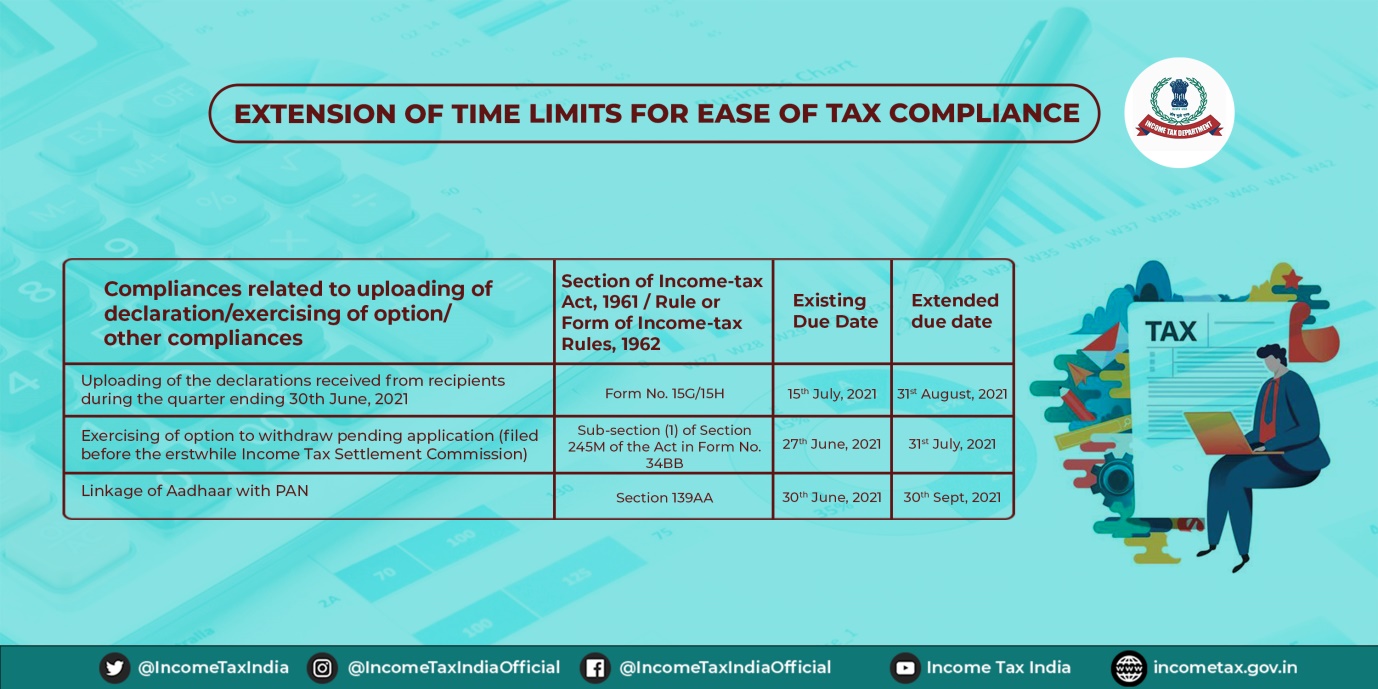

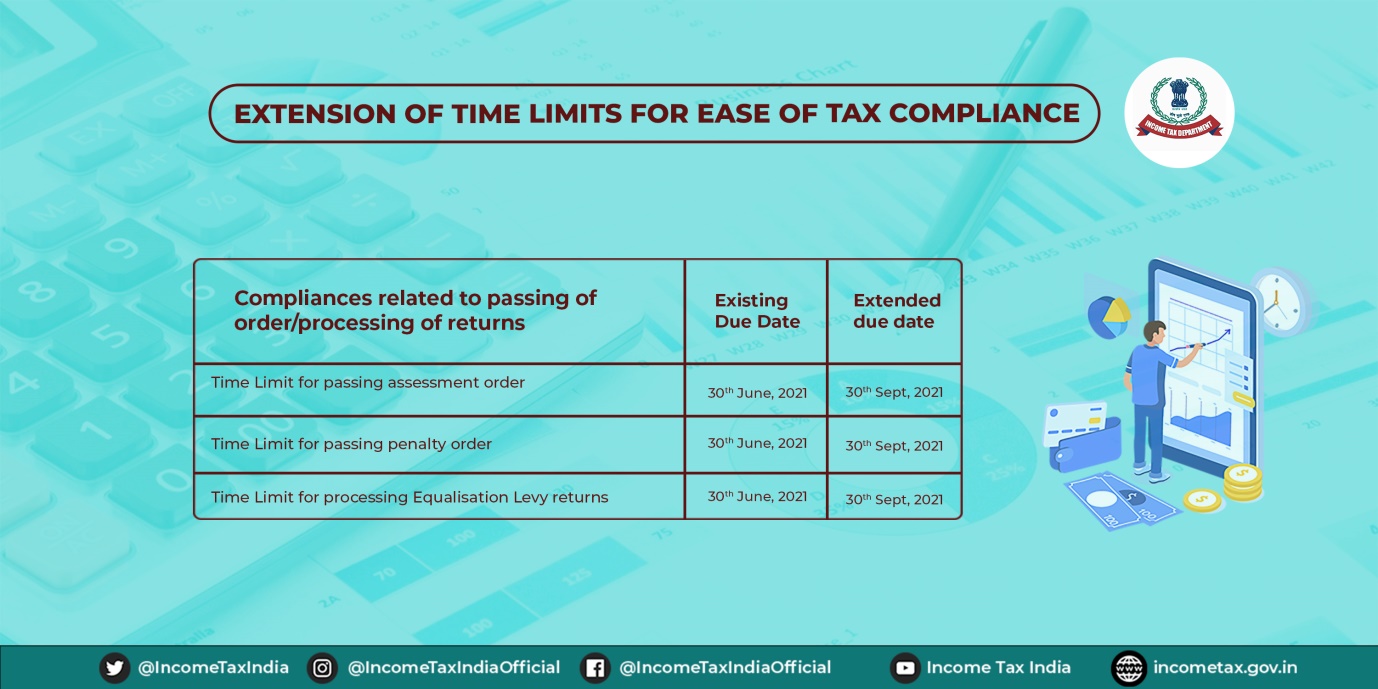

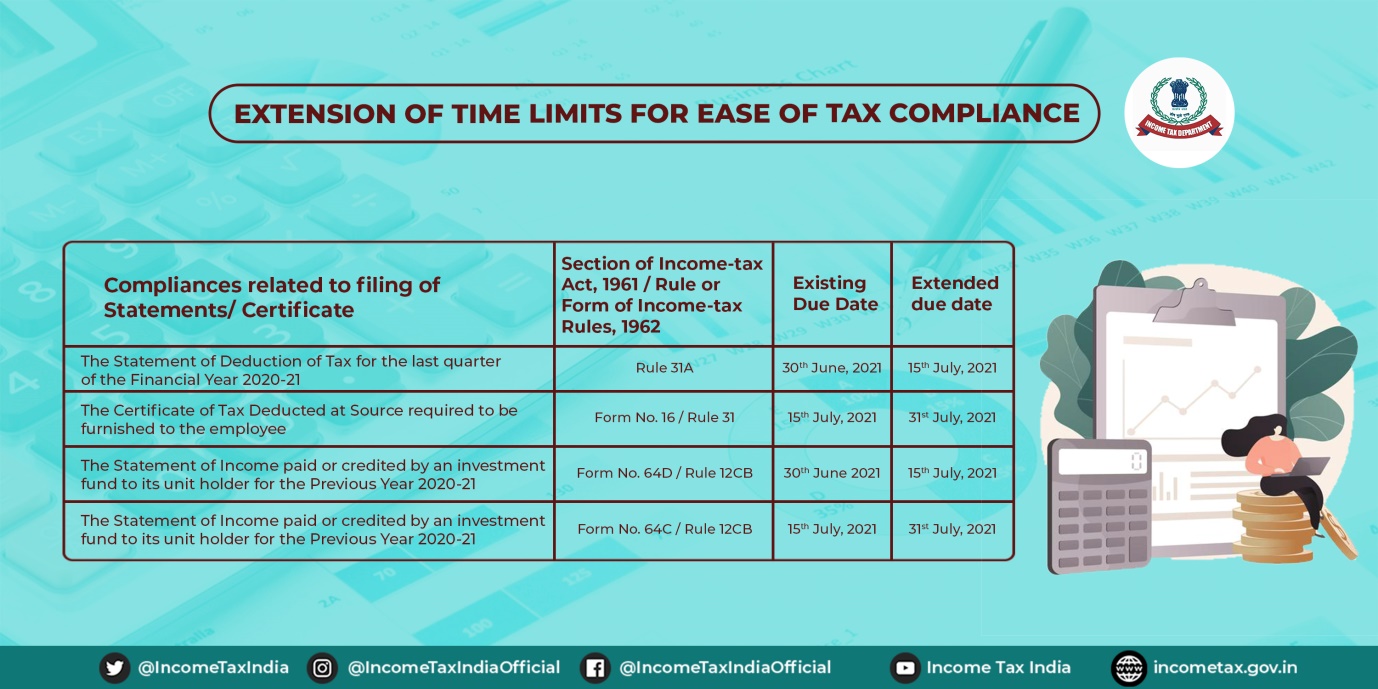

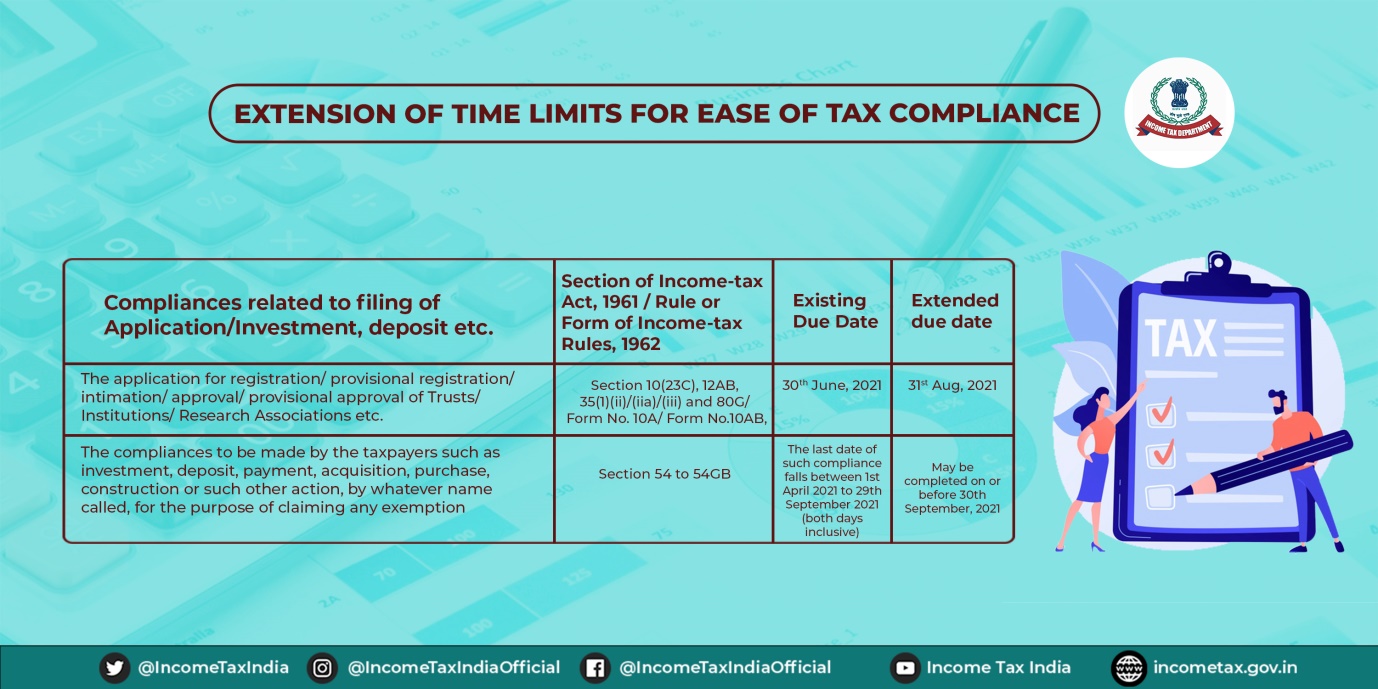

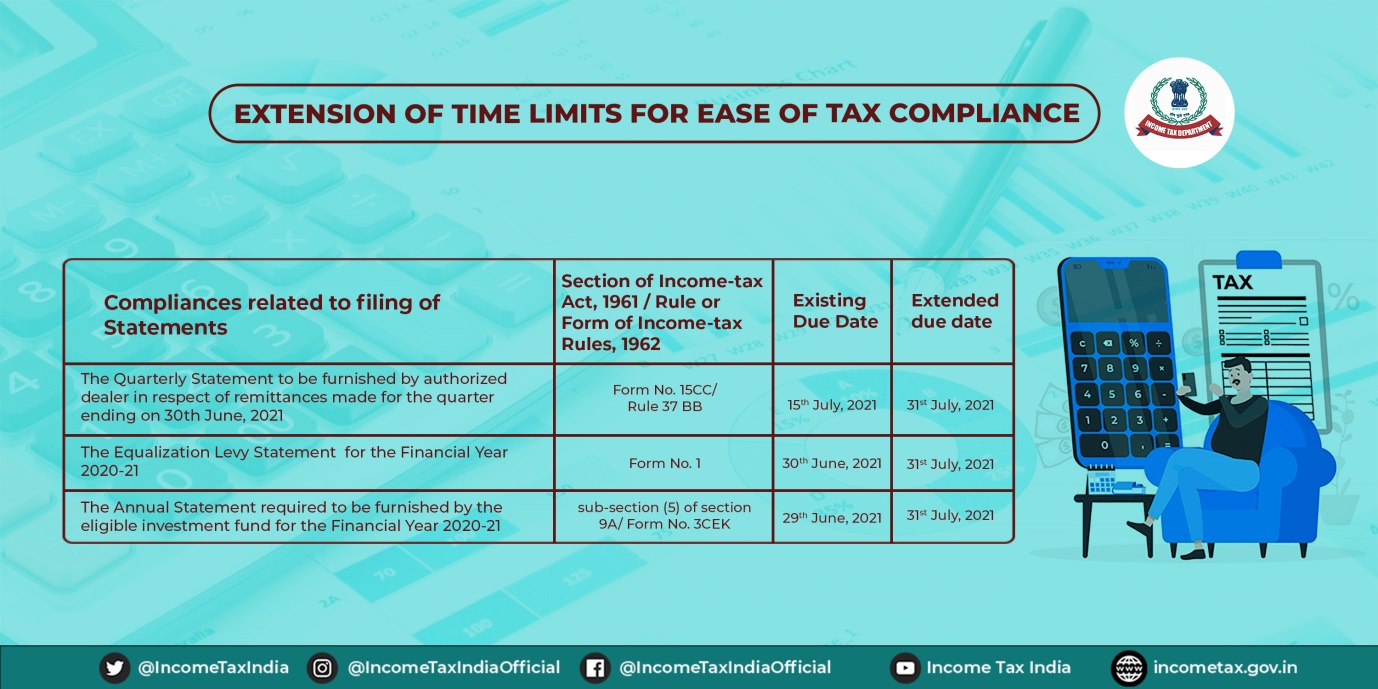

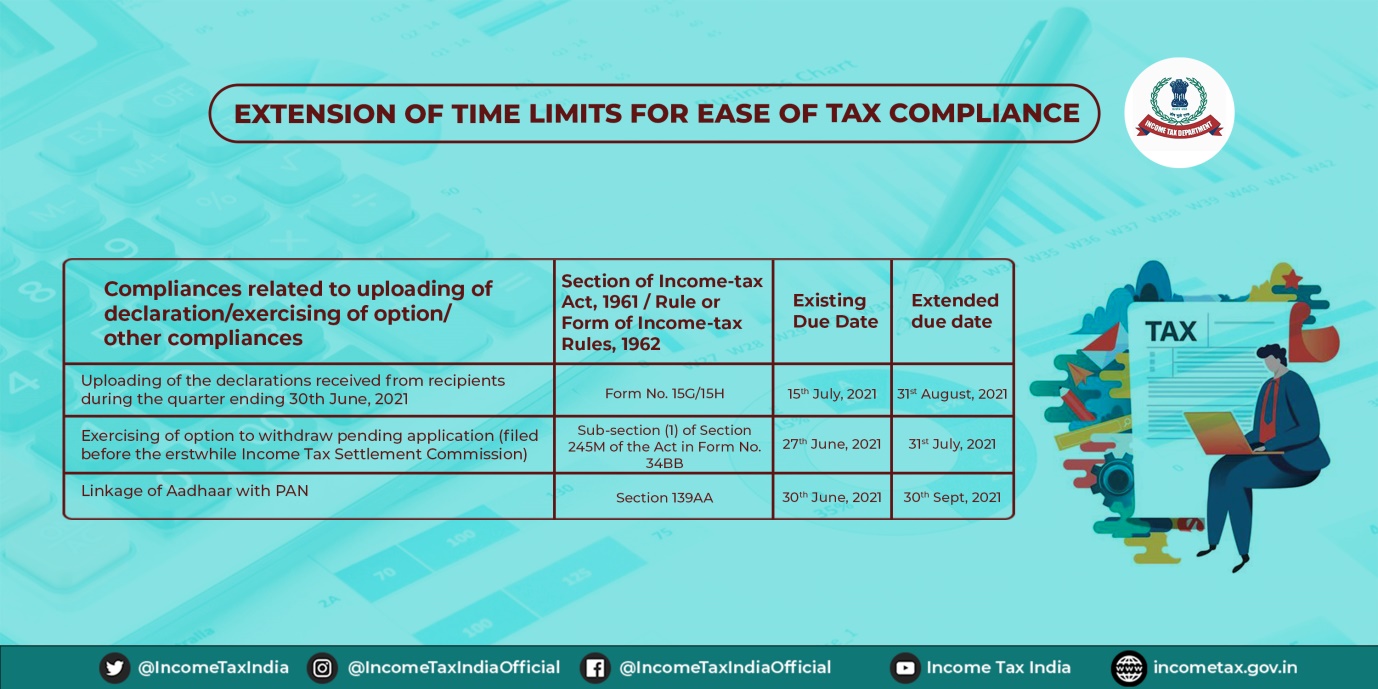

3. Extension of time limit of certain compliances :

The Ministry of Finance extended the due date of certain income tax compliances to provide relief to taxpayers in view of the severe pandemic.

(Circular No. 12 of 2021, Dated 25th June, 2021)

4. Section 206AB and 206CCA of the Income-tax Act, 1961 :

Finance Act, 2021 inserted two new sections 206AB and 206CCA in the Income-tax Act 1961 which takes effect from 1st day of July, 2021. These sections mandate tax deduction or tax collection at higher rate as specified in case of certain non-filers (specified persons). However, to reduce compliance burden the Central Board of Direct Taxes has issued a new functionality “Compliance Check for Sections 206AB & 206CCA” to check functionality for Section 206AB & 206CCA

(Notification No. 01 of 2021, Dated 22ndJune, 2021 and Circular No. 11 of 2021, Dated 21st June, 2021)

5. Clarification issued by income tax for new TDS section applicable on purchase of goods :

Under the new section 194Q of Income Tax Act, buyer of goods is required to deduct TDS at the rate of 0.1% from the payments made for the purchase of goods if his turnover exceeds 10 Crore rupees during the financial year immediately preceding the financial year in which the purchase of goods is carried out. Moreover, this TDS is applicable if the purchase of goods by the buyer from the seller is of the value or aggregate of such value exceeding fifty lakh rupees in the previous year. Considering various representations, certain clarifications are issued. Highlights of the same are as follows:

– Section will not be applicable for securities and commodities traded through exchange

– Section will not be applicable for amount credited to ledger of party or payment made before 1st July 2021

– For limit of 50 lakhs, purchase made or payment made in Q1 of 2021-22 will also be considered

– TDS on GST component will be applicable if TDS is applicable on payment basis

– TDS can be reversed on purchase return (unless goods are replaced)

– TDS on purchase of goods will be applicable in case of non-resident buyer only if PE is established in India and purchase is connected to that PE

– TDS on purchase of goods will not be applicable if seller’s income is exempt u/s 10 or under any other act

– TDS on purchase of goods will not be applicable if buyer is a company and transaction is done in the year of incorporation

– While calculating limit of 10 crores of buyer’s turnover, income from non-business activity will not be considered

– For any reason if seller has collected TCS, before buyer can deduct TDS; buyer is not required to deduct TDS

(Circular No.13 of 2021 of 30th June 2021)