The Republic of Cyprus is an island, member state of the EU and Eurozone and is located in the South-East Mediterranean Sea. Cyprus is very popular with tourists because of its good weather, amazing blue flag beaches and ancient monuments that bear witness to over 10,000 years of history. Since the early 1990’s Cyprus has also become a popular international business centre.

In this insight, we discuss some of the advantages of setting up business in Cyprus and specifically Cyprus Company as a business gateway to EU.

Strategic Location

Cyprus is located at the crossroads of 3 Continents (Europe, Asia and Africa) in the South-east Mediterranean Sea and it is the eastern post of the European Union.

Travelling to Cyprus from India, Asia etc. by air is shorter by 3-5 hours compared to travelling to mainland Europe which makes it easier and less costly for both persons and goods to reach Cyprus.

Use of English Language

English is used very widely both by the general population and in the business world, moreover, the vast majority of official documents (laws etc.) are available in the English language and it is acceptable in communicating with government departments and agencies.

Business-friendly

A Cyprus company can be registered and be fully operational within a week from the submission of official documents.

An investor may register his company in Cyprus without having to visit the island in person. It may also be possible to open a corporate bank account without visiting Cyprus.

Cyprus law is based on UK common law principles and also incorporates EU legislation.

Advantageous Tax System

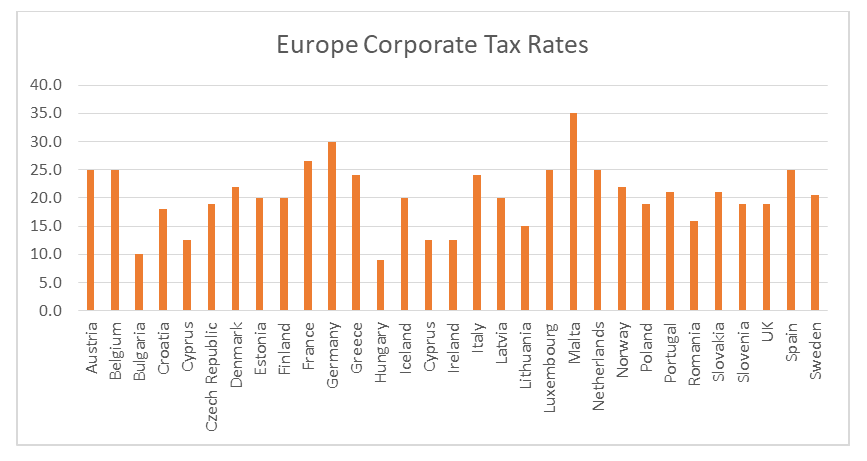

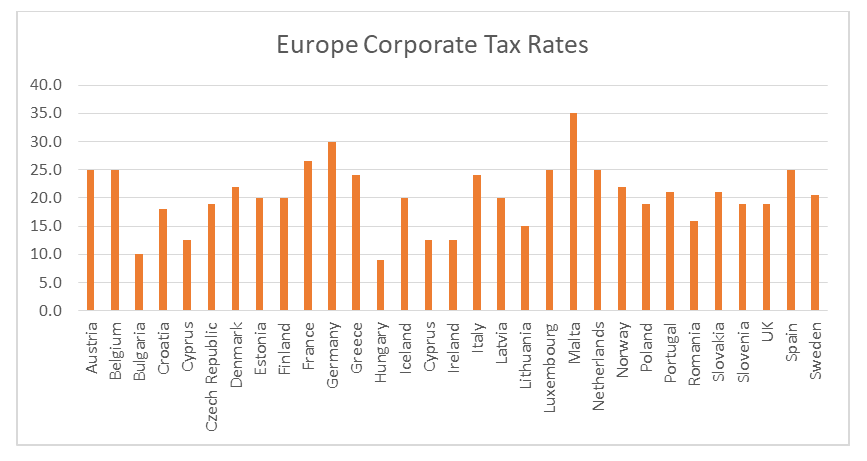

- The corporate tax rate is just 12.5% (one of the lowest in EU)

- No tax on dividend income (received by companies or Cyprus non tax resident individuals)

- No tax on interest (except for financing companies)

- Capital Gain Tax only applies to the sale of land and buildings located in Cyprus

- There is a very wide network of favourable double taxation treaties

- In most cases withholding tax on dividends and interest paid from Cyprus is 0%

- EU and OECD compliant

- There are tax incentives for investing in Cyprus companies and employment of qualified professionals seeking employment for first time in Cyprus

Data source: eu.europa.eu

Low Operational Costs

Rental Prices:

City commercial and retail rents in Cyprus are only a fraction of those in mainland Europe. Office rent can be as low as Eur 12 per sqm/ per month. A City two-bedroom apartment (around 100sqm) can be around Euro 750 per month.

Highly Qualified Staff at Competitive Costs:

55% of the population in Cyprus attends 3rd Level education with UK being one of the most popular destinations for university studies. This means that it is relatively easy to hire highly equipped professionals and the cost of employment is much lower than mainland EU.

Advanced Infrastructure

Due to its small size, Cyprus is one of the first countries to adopt new technologies in business and everyday life. High-speed internet, online governance, high-end internet and mobile banking are all part of everyday business life in Cyprus.

An Amazing Place to Visit and Do Business

Beautiful weather all year round, welcoming attitude to visiting foreigners, Mediterranean cuisine, one of the safest countries in the world (ranked 5th globally), heritage dating back thousands of years, most beautiful blue flag beaches in EU (Eurostat) and the best quality bathing water in EU (2020 EU environment agency) are some additional reasons for considering Cyprus as your business gateway to Europe.