In addition to human casualties on both sides and the severe effects on the infrastructure and economy of Ukraine, the Russia – Ukraine tension has caused a recession in most countries around the world. Although everyone is affected, some industries in EU are affected more than the others.

In this insight, we examine the industries most negatively affected by this tension.

Most Impacted Industries in the EU:

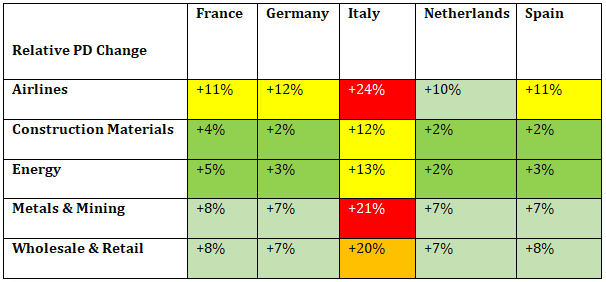

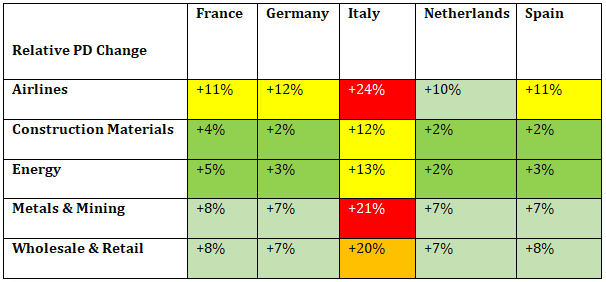

Table 1: Industries with the highest increase in Probability of Default (PD) in the Baseline scenario

Source: S&P Global Market Intelligence. As of June 15, 2022. For illustrative purposes only (France, Germany, Italy, Netherlands and Spain).

Airlines: The closing of Russian airspace and ban on overflights forced airlines to reroute their flights adopting longer routes requiring incurring increased fuel and crew costs. This factor together with the increase in Jet fuel caused in increase in flight tickets. The airline industry was already a very competitive one with low margins and now the increased flight prices and longer flight durations is discouraging price-sensitive / leisure clients from travelling creating a big challenge for airlines in their effort to recover increased costs and stay profitable.

Energy: EU countries, in recent years have created a dependency on gas from Russia. Russia-Ukraine tension has upset the smooth supply of Gas from Russia to Europe with question mark as to whether it will continue at all. European countries like Germany and others are now in desperate need to find alternative suppliers but this is by no means an easy task. The increased demand and shortage of supply to Europe is pushing prices up with inflationary pressures on the whole economy. The alternative solutions to Gas supplied through gas pipes from Russia also have much higher transportation costs which inevitably is transferred to the consumers.

Wholesale & Retail: Although this sector is not severely affected by energy costs, it is affected is affected significantly by inflationary pressures resulting both from energy prices but also from raw materials price increase in farming. Ukraine is a major supplier of grains, and the disruption of this supply of grains together with low production of grains in South America this

season due to adverse weather conditions has caused agricultural raw materials to almost double in price having a knock-on effect on all products using them is raw materials. The rising inflation will inevitably push up employee costs up and erode the margins of retailers. Some consumer product manufacturers instead of increasing prices have reduced the size of their products whilst maintaining similar prices thereby giving rise to a new term “shrinkflation” but there are reports to consumers reacting to this practice.

Construction Materials: This sector is another victim of high energy costs and inflationary pressures in general as well as supply chain disruptions. Companies in this sector depending largely on energy eg cement producers have seen a noticeable increase in their costs. These companies are also affected by the general economic recession since the tension started and caused households to postpone their plans to invest in new households.

Metals & Mining: This is a sector significantly dependent on energy and hence it is directly affected by increased energy costs. The reduction in metal exports from created increases in prices which are passed on to the consumers. The volatility of metal prices though is still a significant risk for this sector.