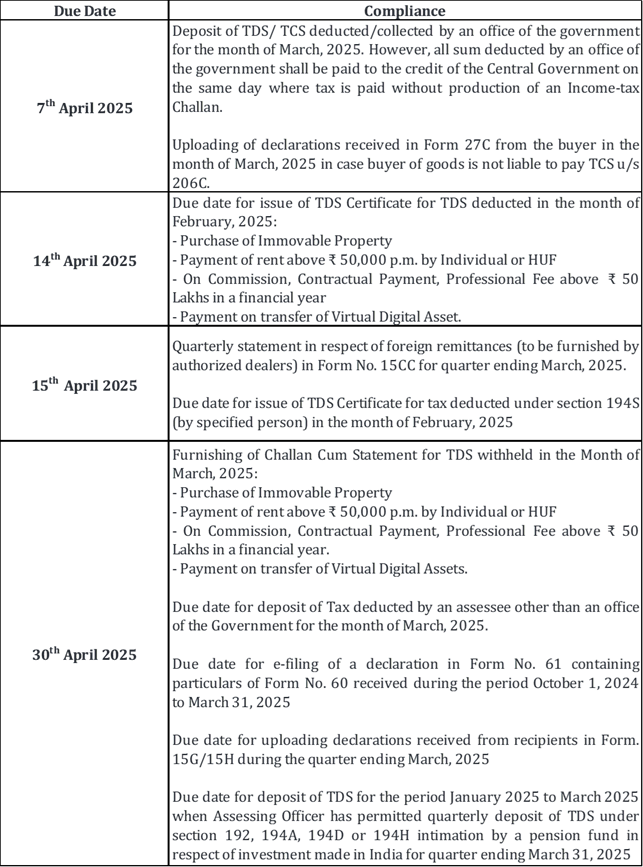

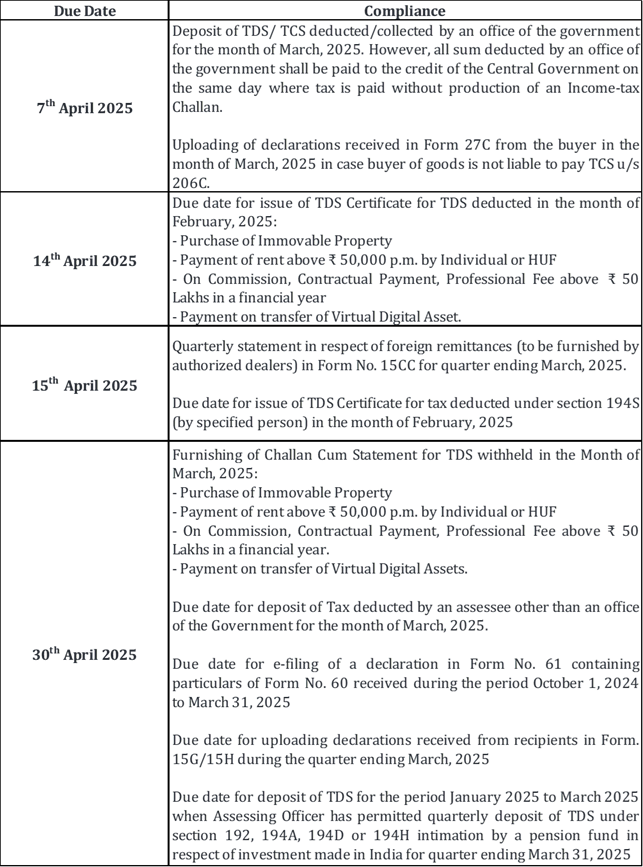

Due Date for Income tax Compliance (April 2025)

Income Tax Updates –March, 2025

1. Key Direct Tax amendments applicable from April 1, 2025

The Hon’ble Finance Minister, Smt. Nirmala Sitharaman, presented the Union Budget 2025-26 on February 1, 2025, marking her eighth consecutive budget. The Finance Bill 2025 has received assent on March 29, 2025. The Finance Bill 2025 proposes several amendments aimed at simplifying tax compliance, encouraging voluntary compliance, and promoting investment and employment. For further detail refer the link below.

https://skpatodia.in/blog/key-direct-tax-amendments-applicable-from-april-1-2025/

2. Waiver on levy of interest u/s 201(1A)(ii) OR 206(7) as the case maybe, in specific cases

(CIRCULAR NO. 5/2025 [F.NO. 275/92/2024-IT(BUDGET)]DATED 28.3.25)

The CBDT has allowed a waiver or reduction of interest under Sections 201(1A)(ii) and 206C(7) for TDS/TCS payments delayed due to technical glitches beyond the taxpayer’s control. If the taxpayer initiated the payment on time but the funds reached the government late due to system issues, they can apply for a waiver within one year. The CCIT, DGIT, or Pr. CCIT will verify the issue and decide within six months. If approved, even previously paid interest may be refunded. The decision will be final and binding with no further appeals.

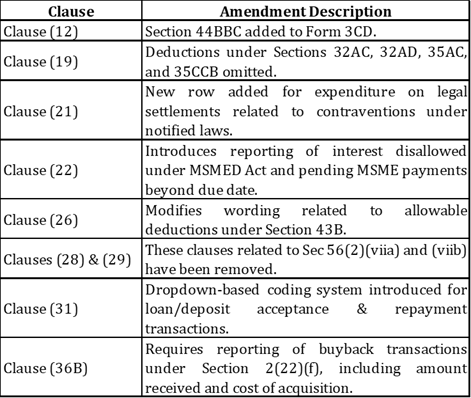

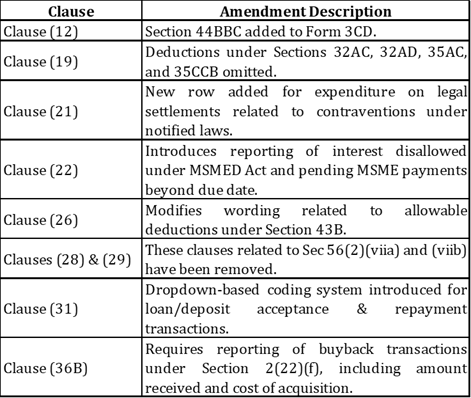

3. Income-tax (eighth amendment) rules, 2025 – amendment in form no. 3CD

(NOTIFICATION G.S.R. 207(E) [NO. 23/2025/F. NO. 370142/10/2025-TPL], DATED 28-03-2025)

The CBDT has introduced amendments to the Income-tax Rules, 1962, effective from April 1, 2025, primarily modifying Form 3CD (Tax Audit Report). Key changes include the addition of Section 44BBC related computation of profit for operation of cruise ships, removal of certain deductions (Sections 32AC, 32AD, 35AC, and 35CCB), and new reporting requirements for MSME payments under the MSMED Act. Additionally, a new clause (36B) mandates reporting of buyback transactions under Section 2(22)(f). The amendments also introduce a dropdown-based classification system for reporting loan/deposit transactions with specific codes for various payment methods. These changes aim to improve compliance, enhance reporting accuracy, and ensure better tracking of financial transactions.

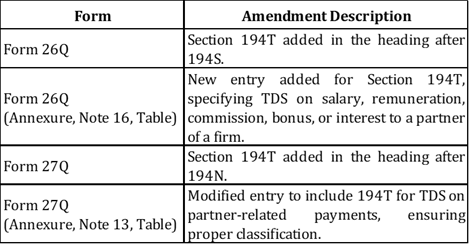

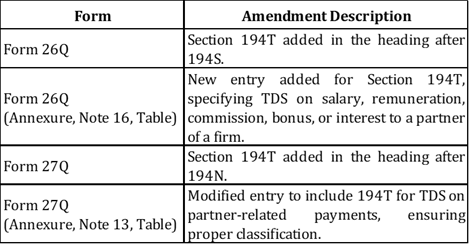

4. Income-tax (seventh amendment) rules, 2025 – amendment in form nos. 26Q and 27Q

(NOTIFICATION G.S.R. 195(E) [NO. 22/2025/F.NO. 370142/08/2025-TPL], DATED 27-3-2025)

In exercise of the powers conferred by section 295, read with section 194T of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962.

Income Tax Judgements –March, 2025

A. No sec. 56(2)(x) additions if new flat was received by assessee in lieu of old flat surrendered by him: ITAT

(IN THE ITAT MUMBAI BENCH Anil Dattaram Pitale vs. Income-tax Officer [2025] 173 taxmann.com 51 (Mumbai – Trib.)[17-03-2025]

1. Brief of the Case

The assessee had purchased a flat in FY 1997-98. The housing society underwent redevelopment, and as per the agreement with the developer, the assessee surrendered the old flat and received a new flat in exchange. The stamp duty value of the new flat was ₹25.18 lakhs, while the indexed cost of the old flat was ₹5.43 lakhs. The Assessing Officer (AO) treated the difference of ₹19.75 lakhs as income under Section 56(2)(x) and added it to the assessee’s taxable income. This addition was confirmed by the Commissioner of Income Tax (Appeals) [CIT(A)].

2. Issue Involved

The key issue was whether the receipt of a new flat in exchange for the old flat during redevelopment should be taxed under Section 56(2)(x) as income from other sources or whether it should be treated as a capital gains transaction eligible for relief under Section 54.

3. Tribunal Decision

The Tribunal held that this was a case of extinguishment of rights in the old flat in exchange for a new one, not a case of receiving immovable property for inadequate consideration. Therefore, Section 56(2)(x) was not applicable. The Tribunal further observed that if the transaction attracted capital gains tax, the assessee would be eligible for deduction under Section 54, effectively resulting in no tax liability. Accordingly, the Tribunal set aside the CIT(A)’s order and directed the AO to delete the addition, ruling in favor of the assessee.

B. No deemed dividend if assessee maintained ledger of Co. and transactions were in nature of business transactions: ITAT (ACIT vs. Windlass Steel Crafts LLP [2025] 172 taxmann.com 350 (Delhi – Trib.)[25-02-2025]

1. Brief Facts

The case involves Windlass Steel Crafts LLP, which was originally a partnership firm before being converted into a Limited Liability Partnership (LLP) on 25th February 2014. The assessee was engaged in the business of manufacturing and exporting handicraft products. During the assessment year 2014-15, the assessee received loans and advances from Windlass Engineers and Services Pvt. Ltd. (WESPL), a closely held company in which the partners of the LLP held substantial shareholdings—Sudhir Kumar Windlass held 45% and Pradeep Kumar Windlass held 50%. The Assessing Officer (AO) treated these loans as “deemed dividend” under Section 2(22)(e) of the Income-tax Act, 1961, on the grounds that the transactions indirectly benefited the shareholders.

2. Issue Involved

The primary issue before the court was whether the loans and advances from WESPL to the assessee-LLP could be classified as “deemed dividend” under Section 2(22)(e). The AO argued that since the partners of the LLP held significant shares in WESPL, the loans were effectively for their benefit, thereby attracting the provisions of the section. However, the assessee contended that these transactions were part of regular business dealings, evidenced by a running ledger account showing trade advances, repayments, and reimbursements. The assessee also emphasized that the LLP itself was not a shareholder in WESPL and that the loans were not diverted for the personal benefit of the partners.

3. Decision

The Income Tax Appellate Tribunal (ITAT), Delhi Bench, ruled in favor of the assessee. The tribunal held that for Section 2(22)(e) to apply, the payment must be made either to a shareholder or for their individual benefit. Since the LLP was not a shareholder in WESPL, the deeming provision could not be extended to treat it as one. Additionally, the tribunal observed that the transactions were in the nature of ordinary business dealings, with no evidence to suggest that the loans were diverted for the personal gain of the shareholders. The AO had failed to establish that the payments were made for the individual benefit of the partners, and the mere existence of a shareholder relationship did not automatically invoke the deemed dividend provisions.

The court further noted that the loans were part of a long-standing business relationship between the assessee and WESPL, involving mutual trade advances and reimbursements. The ledger account maintained by the assessee demonstrated that the transactions were commercial in nature and not disguised dividends. Consequently, the tribunal upheld the decision of the Commissioner of Income Tax (Appeals) to delete the addition made by the AO and dismissed the revenue’s appeal. The ruling reaffirmed that Section 2(22)(e) applies only when payments are made for the direct or indirect benefit of shareholders, and not to genuine business transactions conducted in the ordinary course.