Due Date for Income tax Compliance (April 2023)

| Due Date |

Compliance |

| 7th April 2023 |

Payment of TDS deducted in the month of March, 2023 by Government Office. |

| 14th April 2023 |

Issue of TDS Certificates for TDS deducted in the month of February, 2023 :

• Purchase of Immovable Property

• Payment of rent above ₹ 50,000 p.m. by Individual or HUF

• On Commission, Contractual Payment, Professional Fee above ₹ 50 Lakhs in a financial year

• Payment on transfer of Virtual Digital Assets |

| 15th April 2023 |

Furnishing of quarterly statement in respect of foreign remittances for quarter ending 2023 by Authorized Dealers. |

| 30th April 2023 |

• Payment of TDS withheld in the Month of March, 2023 :

– On Purchase of Immovable Property

– On rent above ₹ 50,000 p.m. by Individual or HUF

– On Commission, Contractual Payment, Professional Fee above ₹50 lakhs in a financial year

– On transfer of Virtual Digital Assets

– On other payments as specified under TDS provisions• Furnishing of declaration in Form 61 containing particulars of Form 60 ie

by Individual or person (not being a company a firm) who does not have PAN and have transactions specified under Rule 114B during the period 1.10.2022 to 31.03.2023• Declaration for certain income without deduction of tax in Form 15G by individual or person (not being a company or firm) and in Form 15H by individual of age 60 or above for the quarter ending March, 2023.• Quarterly deposit of TDS for the peri – On Purchase of Immovable Property- On payment of Salaries

– On payment of interest other than securities

– On payment of Insurance Commission

– On payment of commission or brokerage

• Furnishing of Form 24G for payment of TDS deducted in the month of March, 2023 by Government Office. |

Finance Bill, 2023 receives President’s Assent

Union Budget for 2023-24 was presented on 01.02.2023 by Hon’ble Finance Minister Smt. Nirmala Sitaraman. (Please refer budget analysis of Finance Bill, 2023 by referring following links)

https://www.linkedin.com/posts/skpatodia.in_budget-analysis-part-4-activity-7027638580910956544-7_GH?utm_source=share&utm_medium=member_desktop

https://www.linkedin.com/posts/skpatodia.in_budget-analysis-part-2-activity-7027238991296892928-vaIQ?utm_source=share&utm_medium=member_desktop

https://www.linkedin.com/posts/skpatodia.in_other-side-of-the-coin-budget-activity-7030493604955496448-I7oj?utm_source=share&utm_medium=member_desktop

https://www.linkedin.com/posts/skpatodia.in_file-itr-before-due-date-activity-7029046097536770048-wXrA?utm_source=share&utm_medium=member_desktop

In Finance Bill, 2023 changes has been given effect to the proposal presented. Lok Sabha Passes Finance bill with amendments on 24.03.2023. (Please refer our article on the same by referring given below link).

https://skpatodia.in/blog/finance-bill-2023-gives-effect-to-the-proposals-of-fy-2023-24-presented-on-1st-february-2023-lok-sabha-passes-finance-bill-with-amendments-on-24th-march-2023/

Further Bill passed in the Rajya Sabha on 27.03.2023 and finally got the ascent of Hon’ble President of India.

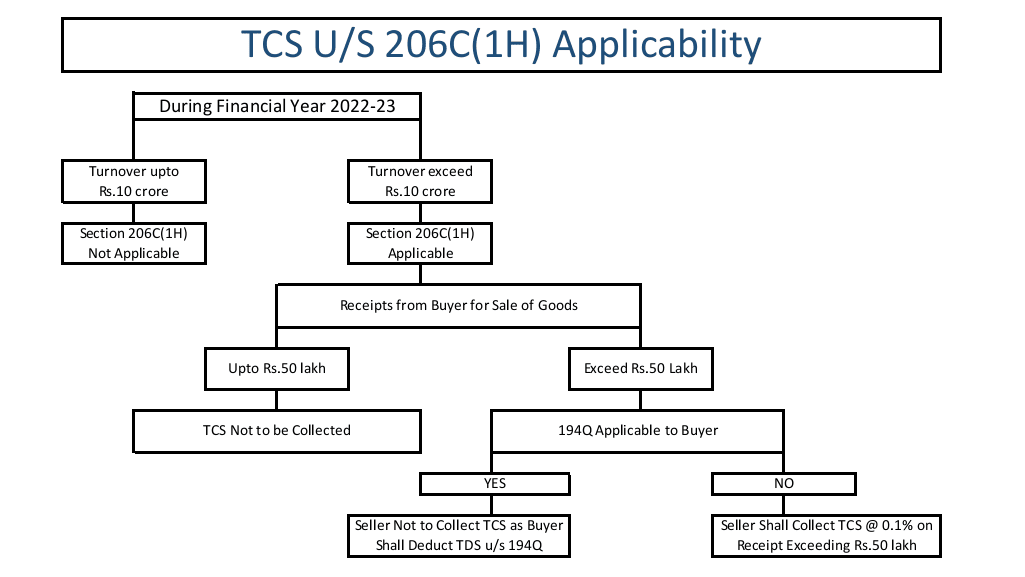

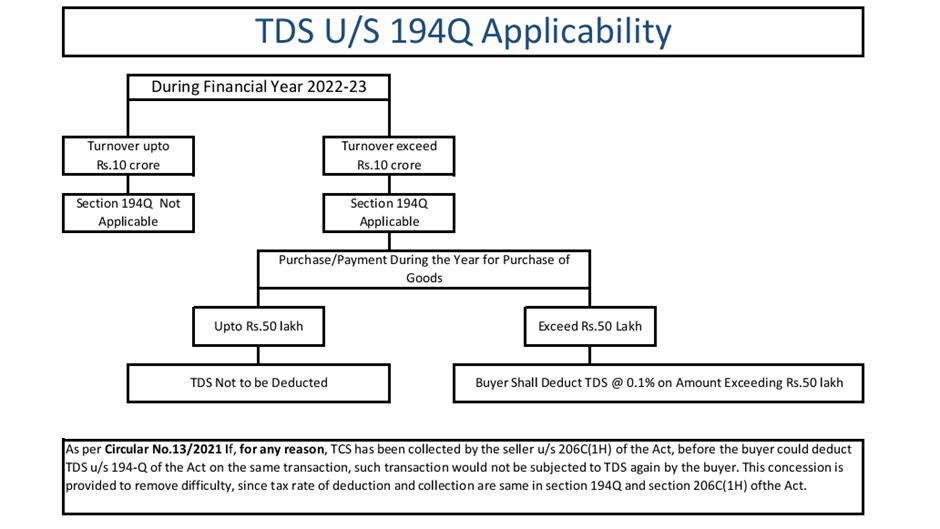

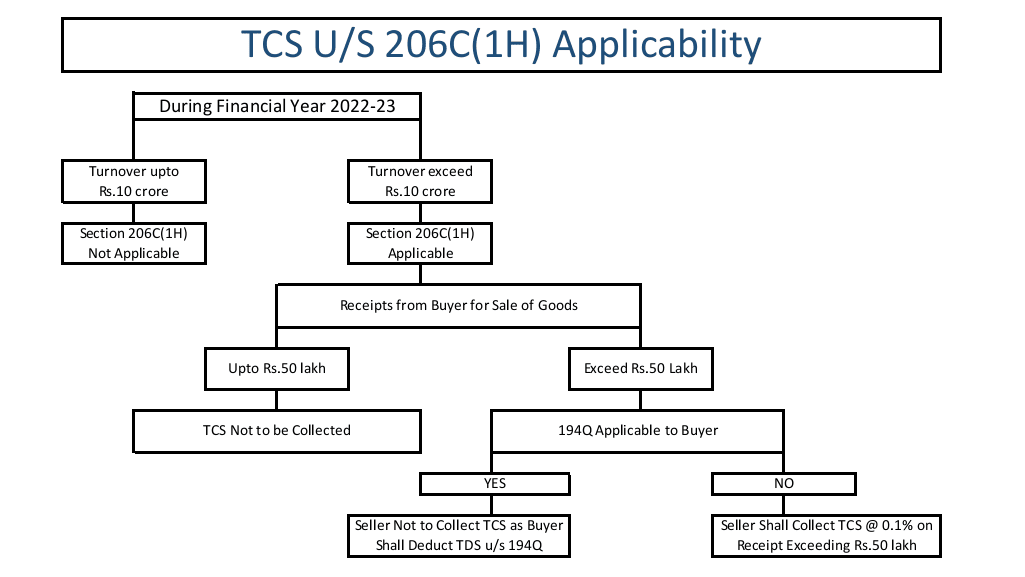

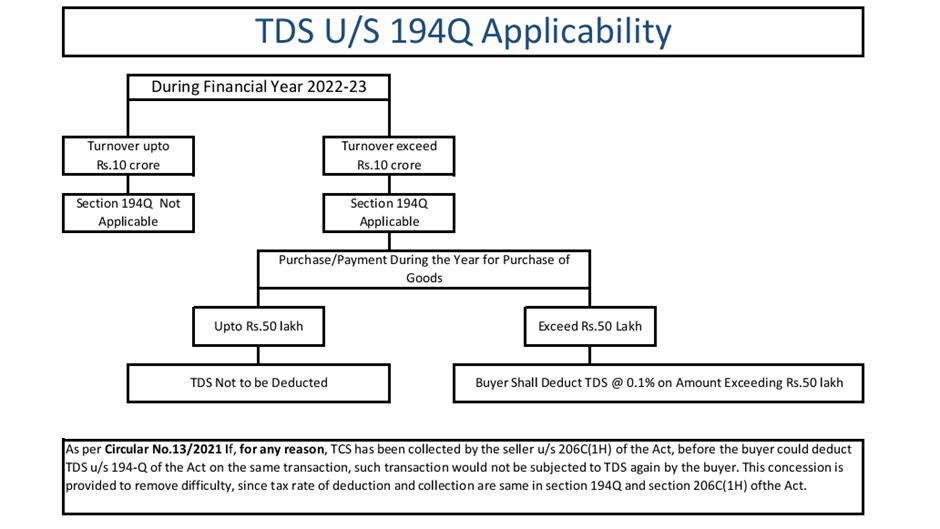

Applicability of TDS/TCS Provisions on Goods for F.Y.2023-24

New financial year is about to start and it requires the buyer/seller of goods to check the applicability of TDS/TCS provisions for FY 2023-24 based on turnover of FY 2022-23.If in your case Turnover in F.Y.2022-23 exceeds Rs.10 crores then provisions of Section 194Q and Section 206C(1H) shall be applicable with effect from 01/04/2023 once specified conditions are fulfilled.

For your knowledge purposes & to check if provisions Sections 194Q and Section 206C(1H) are applicable to you, we have briefly presented in PPT for applicability of the same.

Further, as you must be aware that definition of goods is wide enough to cover certain unusual expenses under definition of “goods” and TDS/TCS provisions are applicable.

The term ‘goods’ is not defined in the Income-tax Act. However, this term ‘Goods’ has been defined under the Sale of Goods Act, 1930 and Central Goods and Services Tax Act, 2017 and includes Movable property, any commodity, Shares or Securities, Electricity, Agriculture produce, Fuel, Motor vehicle, Liquor, Jewellery or bullion, Art or Drawings, Sculptures, Scraps, Forest Produce.

Further, guidelines are also issued by CBDT’s Circular No. 13/2021, dated 30-6-2021 and Circular No. 20/2021, dated 25-11-2021.

Notifications/Circulars/Case Laws

1.Income Tax Notification – Relaxation In Online 10F Extended To 30.09.2023 For NR Claiming Benefits Of DTAA

The CBDT vide F. No. DGIT(S)-ADG(S)-3/e-Filing Notification/Forms/2023/ 13420 dated March 28, 2023 extended Form 10F e-filing exemption for Non-residents without PAN till September 30, 2023.

For detailed information please refer our article on the same by referring the link :

https://skpatodia.in/blog/income-tax-notification-relaxation-in-online-10f-extended-to-30-09-2023-for-nr-claiming-benefits-of-dtaa/

2.PAN and Aadhaar Linking Date extended from 31.03.2023 to 30.06.2023

CBDT vide press release dated 28.03.2023 extended the due date of linking PAN & Aadhaar from 31.03.2023 to 30.06.2023. For detailed information please refer our article on the same by referring the link :

https://skpatodia.in/blog/pan-and-aadhaar-linking-date-extended/

3.Changes in Form 26AS From AY 2023-24

The Central Government has notified certain changes in the format of Income tax Return and forms for the year 2023-24. As part of this, certain changes are also incorporated in the Form 26AS/Annual Tax Statement. From AY 2023-24 onwards Annual Tax Statement/Form 26AS available on TRACES will reflect data related to TDS/TCS and other details shall be available in the AIS (Annual Information Statement).