Finance Minister Nirmala Sitharaman presented her record 9th consecutive Union Budget 2026-27 today (on February 1, 2026). Key highlights of direct tax proposals are as under:

- Taxation of Buy Back of shares:

In the event of corporate action of Buy Back of shares, income earned by shareholders is proposed to be treated as Capital Gain, which was previously treated as deemed dividend income and was taxed as Income from Other Sources. For the shareholders who are promoter-shareholders, an additional tax is also proposed to be levied, in addition to the Capital Gains Tax.

- Rationalisation of Due Dates:

The due date for filing the return of income is proposed to be extended from 31st July to 31st August for (i) Assesses having income from profits and gains of business or profession, whose accounts are not required to be audited; (ii) Partners of a firm whose accounts are not required to be audited under this Act or under any other law in force; or the spouse of such partner (condition applied); and (iii) Trusts requiring no audits.

- Revised return time extended:

The revised return due date extended from its existing time limit of 9 months to 12 months from the end of the assessment year in which return was filed. Further, a fee is also applicable for revised returns which are filed beyond 9 months from the end of the Assessment year in which return was filed.

- Relaxation from requirement to obtain TAN:

As per proposed changes Resident individuals and Hindu Undivided Family will no longer need a TAN when purchasing any immovable property from a non-resident seller.

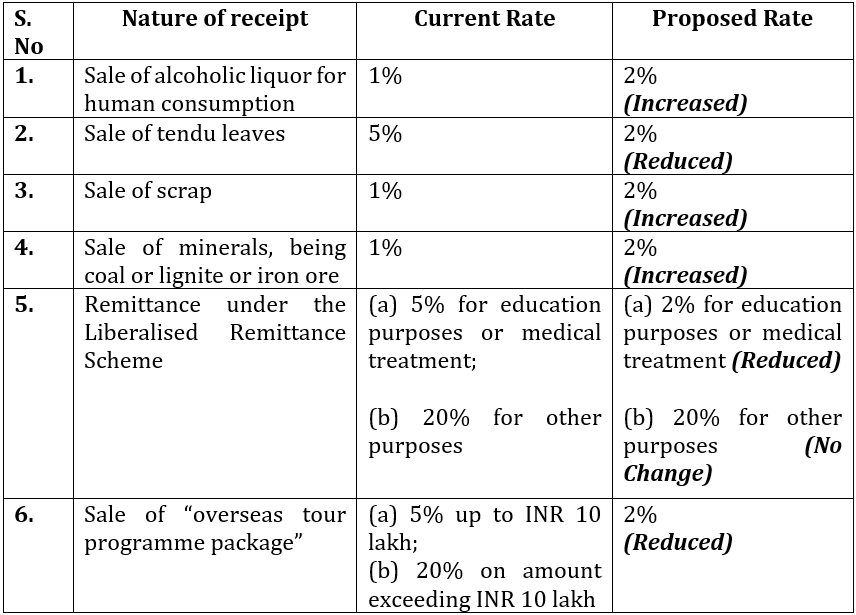

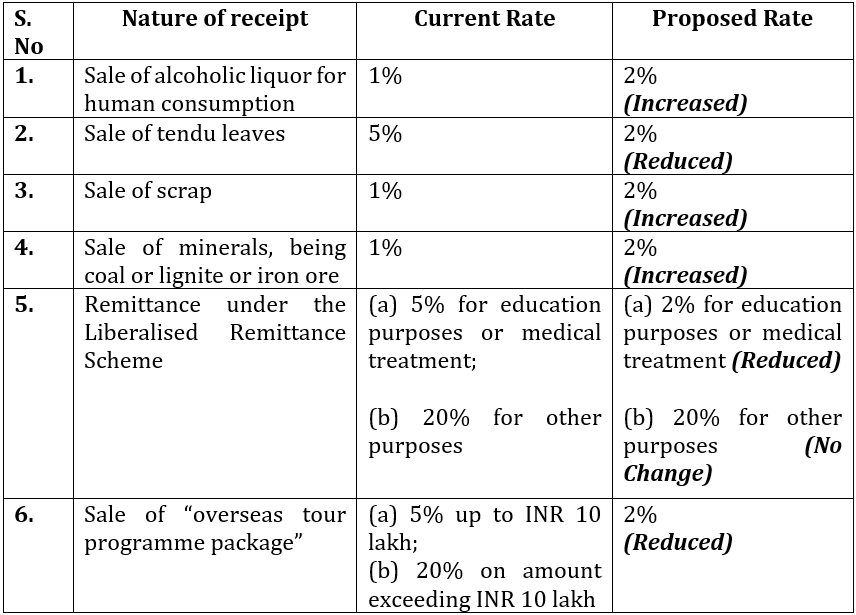

- Proposed changes in TCS rates on below transactions, effective from 01 April 2026:

- Foreign Assets of Small Taxpayers – Disclosure Scheme, 2026 (FAST-DS 2026):

Government proposes a time-bound scheme for voluntary disclosures of foreign assets to small taxpayers with payment of tax or fee and limited immunity from penalty and prosecution, excluding cases involving prosecution or proceeds of crime.

- Exemption on interest income under the Motor Vehicles Act, 1988:

Interest income received by an individual or legal heir under the Motor Vehicles Act, 1988, in cases of death, permanent disability, or bodily injury is proposed to be exempt, and no TDS is proposed to be applicable on such interest.

- Penalty on Reporting Entities of crypto-assets transactions:

It is proposed to introduce a penalty of Rs. 200 per day on a Reporting Entity, if the statement of transaction is not furnished. Whereas, a penalty of Rs. 50,000 is proposed to be applicable, if incorrect information is furnished or failure to correct such inaccuracy.

- Increased Securities Transaction Tax:

With effect from 01 April 2026 following rates of STT are proposed:

- Sale of an Option in securities – from 0.1% to 0.15% of the option premium,

- Sale of an Option where the option is exercised: from 0.125% to 0.15% of the intrinsic price,

- Sale of a Futures in securities – from 0.02% to 0.05% of the traded price.

For our more detailed budget analysis report, please click.