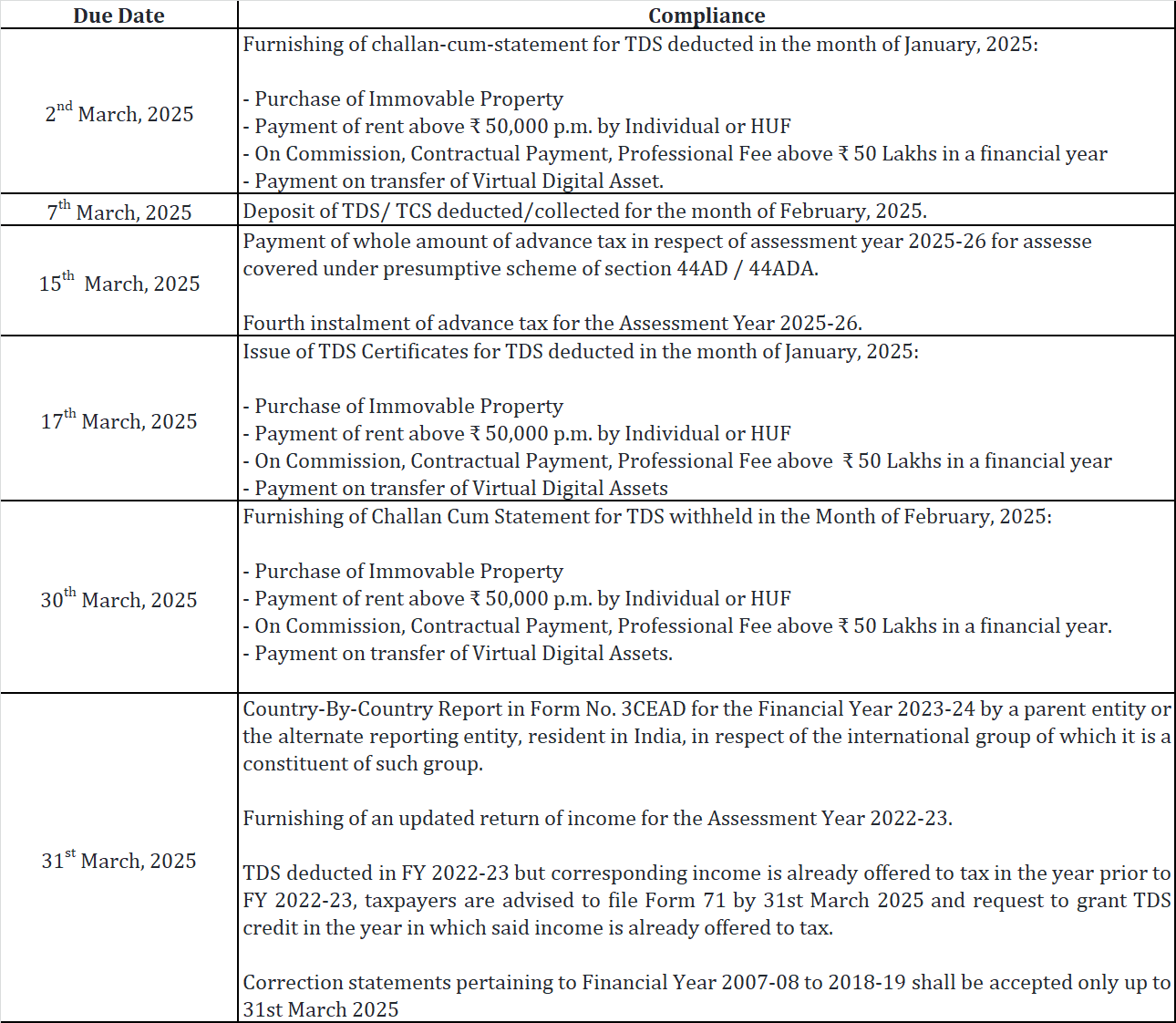

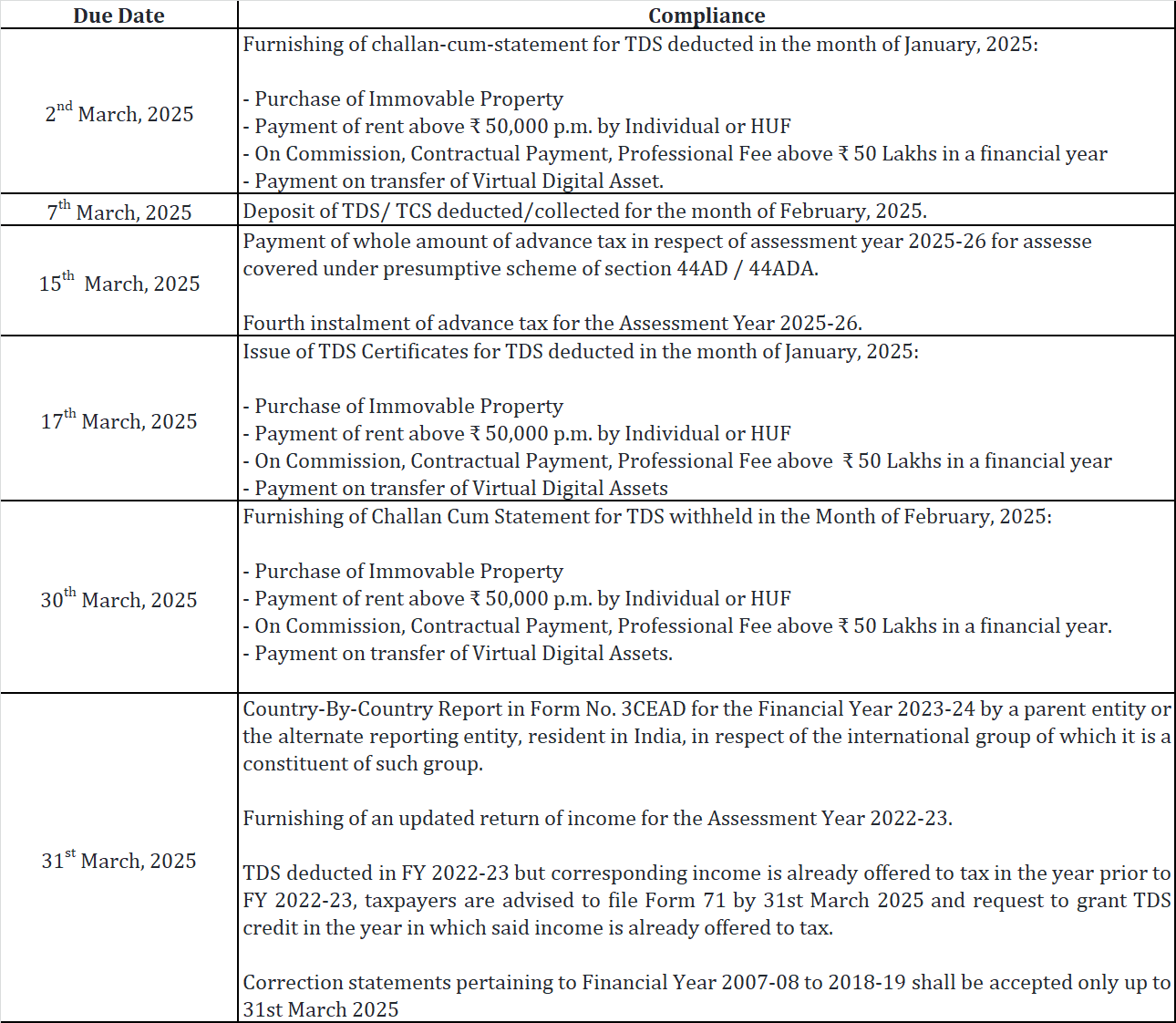

Due Date for Income tax Compliance (March 2025)

For other important due dates of March 2025, please click on this link:

Income Tax Updates –January & February, 2025

1. Highlight of the changes proposed Finance Bill,2025

The Union Budget 2025, presented by FM Nirmala Sitharaman on February 1, 2025, brings significant changes to stimulate economic growth, support the middle class, and ensure fiscal stability. The government has proposed crucial measures to provide relief to individuals and small businesses. For more details, please click on the link below:

https://skpatodia.in/blog/highlights-of-direct-tax-proposals-in-finance-bill-2025/

Finance Bill is likely to receive assent from president in the month of march.

2. Extension of due date of filing of Form No. 56F under the Income Tax Act,1961

(Circular No.2/2025,(F.No. 300173/11/2025-ITA-I) Dated 18.02.2025)

The Central Board of Direct Taxes (‘the CBDT’), in exercise of its powers under section 119 of the Income-tax Act,1961 (‘the Act’), extends the last date for filing of report of the accountant as required to be filed under sub-section (8) of section 10AA read with sub-section (5) of section 10A of the Act, for the Assessment year 2024-25 from the specified date under the section 44 AB of the Act to 31.03.2025.

3. File NIL/lower TDS application for FY 2025-26

The functionality to file application in Form 13 for lower/nil deduction certificate under section 197 of the Income Tax Act 1961 for Financial Year 2025-26 will be available from 28.02.2025 onwards.

4. New Income Tax Bill 2025 – simplified and structured sections

Income Tax Bill 2025 (New bill – was introduced before Lok Sabha) includes simplified and structured sections.

Assessment/ appeal proceedings for tax year 2025-26 (FY 2025-26) and earlier years will be governed by the Present Act. Directions, instructions, notifications, orders or rules issued under Present Act to continue in force (to the extent not inconsistent with new law)

While going through the index of sections and structure of different sections, it is observed that to make provisions of act easy to understand, wherever possible, provisions are presented in tabular format. Further, at the end of certain chapters, “interpretation” section is kept wherein all the relevant definitions are provided. In the existing act, definitions were provided in the form of explanation at the end of sub section/sub clause.

In the new bill, wherever possible, sections are combined and placed under one single section to make it easier. One of the best examples for the same is TDS rates specified for payment to non-resident in section itself and that too in tabular format. In the existing act, Sec 195 provides applicability TDS at the time of payment to non- resident. However, for the TDS rate section, ask the deductor to refer to the RATES IN FORCE and for the said rates, payer is required to refer to different sections and parts of act.

A Parliamentary Committee is formed to deliberate on the Tax Bill, and the Committee will be required to submit its report. Government will consider the Committee’s report to revise the Tax Bill, to the extent require and which will then proceed to Parliament for approval in both houses, followed by the President’s assent to become law.

5. A major relief for Non-Resident Entities operating Liaison Offices (LOs) in India!

A major relief for Non-Resident Entities operating Liaison Offices (LOs) in India!

Earlier, LOs were required to submit Form 49C within 60 days from the end of the financial year (i.e., by May 30). However, with the Finance (No. 2) Bill, 2024, amendment was made in period within which such statement.

Now, as per CBDT Notification No. 14/2025, the due date for filing Form 49C has been extended to 8 months from the financial year-end.

Form 49C contains the key details of the LO such as: Liaison activities undertaken in India, Financial transactions, Employee details and associated expenses, Information on group entities and dealings with Indian parties.

This extension provides much-needed relief for LO’s to ensure timely and accurate compliance.

Income Tax Judgements –January & February, 2025

A. Commissioner of Income Tax (Appeals) Mumbai has allowed Section 87A tax rebate on special rate income like short term capital gains (STCG).

(Source economic times article dated March 6, 2025)

The Commissioner of Income Tax (Appeals) Mumbai has allowed Section 87A tax rebate on special rate income like short term capital gains (STCG).

Why this appeal was allowed by CIT (A)?

There were multiple legal arguments which convinced CIT (A) to allow this appeal. Two of them were:

It is well established that when governments worldwide limit benefits previously available to citizens, they typically make a formal announcement in public or in parliament explaining the rationale behind the change.” The taxpayer referred to the Finance Minister Nirmala Sitharaman Budget 2024 speech and said there is no indication from the FM that rebate is available only on income taxable at slab rates under Section 115 BAC (1A). “On the contrary, the literal interpretation and intent were to provide a higher rebate benefit to those choosing the new tax regime.

Total income is defined in Section 2(45) of the Income Tax Act and it means total amount of income referred to in Section 5. The total income under Section 115BAC(1A) includes all five heads of income, including capital gains. If the legislative intent were to deny the rebate on portions of total income comprising special income, such as that chargeable under Section 111A and 112, these exclusions would have been expressly stated in the provisions.

B. No sec. 68 additions on unsecured loan taken from 50% shareholder to meet business-related expenditure: ITAT [2025] 172 taxmann.com 48 (Mumbai – Trib.)

1. Brief of the Case

The case of Kaisha Lifesciences (P.) Ltd. vs. Deputy Commissioner of Income-tax involved two primary issues: the addition of an unsecured loan under Section 68 and the disallowance of scientific research expenditure under Section 35(2AB). The Tribunal examined these issues in detail and ultimately ruled in favour of the assessee.

2. Issue Involved

Unsecured Loan Under Section 68

Kaisha Lifesciences took an unsecured loan of ₹2.30 crores from Mr. Kairus Dadachanji, a 50% shareholder of the company. The Assessing Officer (AO) considered the loan as unexplained cash credit since the assessee did not provide Dadachanji’s income tax returns, bank statements, or confirmation letter during assessment. As a result, the amount was added to the company’s total taxable income under Section 68. The Commissioner of Appeals upheld the AO’s decision, stating that the assessee failed to establish the identity, creditworthiness, and genuineness of the transaction. However, before the Tribunal, the assessee provided substantial evidence, including the PAN, address, bank statements, and details of repayment, proving that the loan was part of a running account with Dadachanji. Since the lender was a significant shareholder and the transaction was carried out through proper banking channels, the Tribunal concluded that there was no justification for the addition under Section 68 and deleted it.

Scientific Research Expenditure Under Section 35(2AB)

Kaisha Lifesciences claimed a weighted deduction of 150% on its R&D expenditure under Section 35(2AB). The Department of Scientific and Industrial Research (DSIR) granted approval to the company’s research facility from October 25, 2019, to March 31, 2020. The AO restricted the deduction only to expenses incurred after October 25, 2019, disallowing costs incurred before that date. The Commissioner of Appeals supported this view. However, the Tribunal noted that R&D approvals are applicable from April 1 of the financial year in which the application is made. The assessee had filed its application on December 26, 2019, and its research facility was already recognized by DSIR. The Tribunal relied on previous judicial precedents, including Maruti Suzuki India Ltd. vs. Union of India and CIT vs. Claris Lifesciences Ltd., which held that the date of approval is not relevant for claiming deductions if the facility is already recognized. Consequently, the Tribunal allowed the deduction for expenses incurred from April 1, 2019, and reversed the disallowance.

3. Final Tribunal Decision

The Tribunal ruled in favor of Kaisha Lifesciences on both issues. The addition under Section 68 was deleted as the company successfully established the identity and creditworthiness of the lender, who was a 50% shareholder. Regarding the R&D expenditure, the Tribunal held that the deduction under Section 35(2AB) should be allowed from April 1, 2019, despite DSIR granting approval later in the year. It also directed verification of ₹5.70 lakhs, which might have been disallowed twice. The overall decision provided significant relief to the assessee, reinforcing the principle that substantive evidence should prevail over procedural deficiencies in taxation matters.

C. FIIs earning derivative income (wherein underlying asset is shares) is taxable in India?

FIIs from jurisdictions like Mauritius do not pay capital gains tax on Income from Derivatives based on Clause (3A) of Article 13 to the Double Taxation Avoidance Agreement (DTAA).

However, recently matter of some FIIs is in news that income tax officer have claimed tax even on the detivatives on the grounds that equity derivatives are closely linked to equities, since stock derivatives derive their value from stocks, the underlying asset, derivative gains should be taxed like gains from shares.

It is also heard that the Dispute Resolution Panel has upheld tax assessment order issued to said FIIs.

Such news just before closure date of assessment proceedings of FIIs for AY 2023-24 has created new fear.

We can hope that appropriate authority provide directions in few days time and give big relief to FIIs.